Question: Answer and explain why you choose? 1.Which statement relating to the accumulated depreciation account is correct? Select one: A. It is classified as a liability

Answer and explain why you choose?

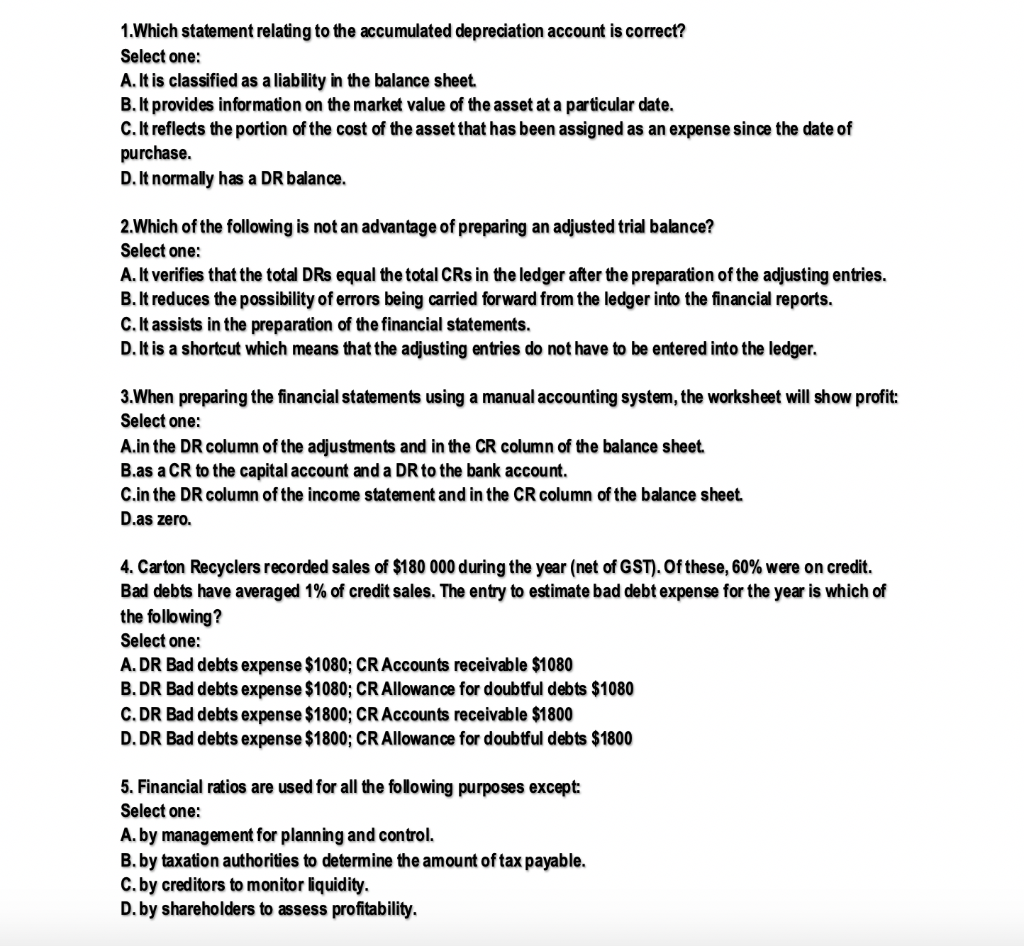

1.Which statement relating to the accumulated depreciation account is correct? Select one: A. It is classified as a liability in the balance sheet. B. It provides information on the market value of the asset at a particular date. C. It reflects the portion of the cost of the asset that has been assigned as an expense since the date of purchase. D. It normally has a DR balance. 2.Which of the following is not an advantage of preparing an adjusted trial balance? Select one: A. It verifies that the total DRs equal the total CRs in the ledger after the preparation of the adjusting entries. B. It reduces the possibility of errors being carried forward from the ledger into the financial reports. C. It assists in the preparation of the financial statements. D. It is a shortcut which means that the adjusting entries do not have to be entered into the ledger. 3.When preparing the financial statements using a manual accounting system, the worksheet will show profit: Select one: A.in the DR column of the adjustments and in the CR column of the balance sheet. B.as a CR to the capital account and a DR to the bank account. C.in the DR column of the income statement and in the CR column of the balance sheet. D.as zero. 4. Carton Recyclers recorded sales of $180 000 during the year (net of GST). Of these, 60% were on credit. Bad debts have averaged 1% of credit sales. The entry to estimate bad debt expense for the year is which of the following? Select one: A. DR Bad debts expense $1080; CR Accounts receivable $1080 B.DR Bad debts expense $1080; CR Allowance for doubtful debts $1080 C. DR Bad debts expense $1800; CR Accounts receivable $1800 D. DR Bad debts expense $1800; CR Allowance for doubtful debts $1800 5. Financial ratios are used for all the following purposes except: Select one: A. by management for planning and control. B. by taxation authorities to determine the amount of tax payable. C. by creditors to monitor liquidity. D. by shareholders to assess profitability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts