Question: answer and explain/ workout problem 1. Assume that an American firm wants to engage in international business without making a major investment in the foreign

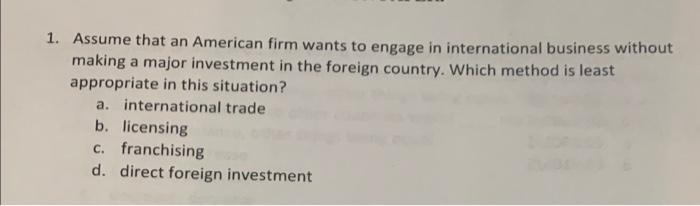

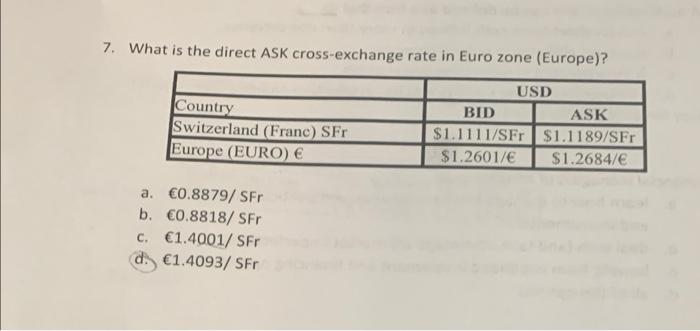

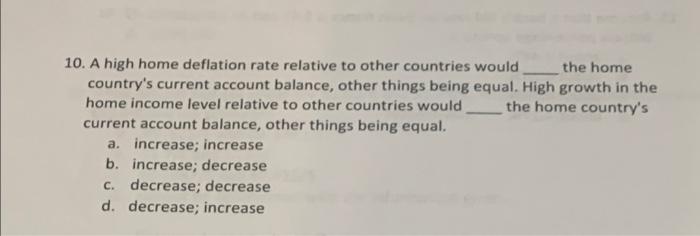

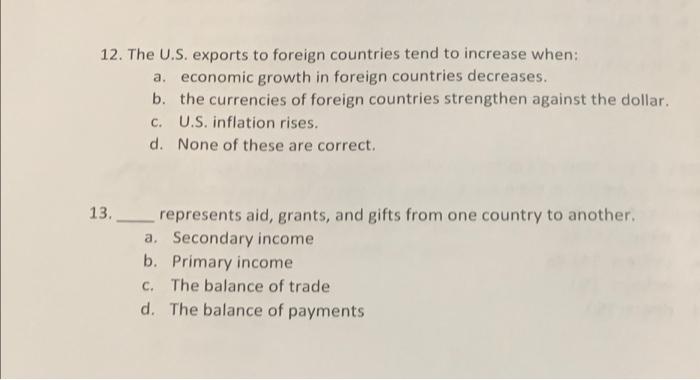

1. Assume that an American firm wants to engage in international business without making a major investment in the foreign country. Which method is least appropriate in this situation? a. international trade b. licensing c. franchising d. direct foreign investment 7. What is the direct ASK cross-exchange rate in Euro zone (Europe)? Country Switzerland (Franc) SFr Europe (EURO) USD BID ASK $1.1111/SFr $1.1189/SFr $1.2601/ $1.2684/8 a. 0.8879/ SFR b. 0.8818/ SFr c. 1.4001/ SFR d. 1.4093/ SFT 10. A high home deflation rate relative to other countries would the home country's current account balance, other things being equal. High growth in the home income level relative to other countries would the home country's current account balance, other things being equal. a. increase; increase b. increase; decrease C. decrease; decrease d. decrease; increase 12. The U.S. exports to foreign countries tend to increase when: a. economic growth in foreign countries decreases. b. the currencies of foreign countries strengthen against the dollar. c. U.S. inflation rises. d. None of these are correct. 13 represents aid, grants, and gifts from one country to another. a. Secondary income b. Primary income c. The balance of trade d. The balance of payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts