Question: Answer and explanation please Willow Corp (a C Corp) reported taxable income before the NOL deduction in the amount of $100,000 in 2020. Willow had

Answer and explanation please

Answer and explanation please

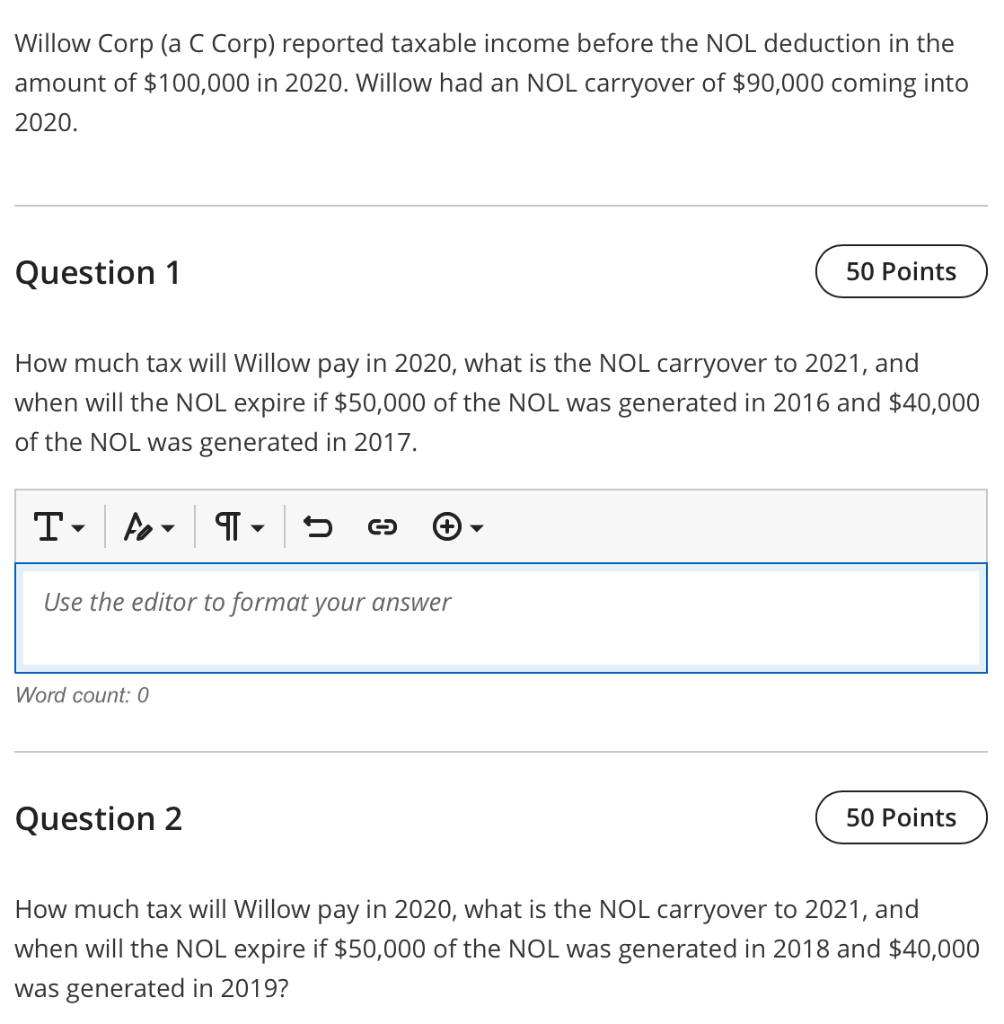

Willow Corp (a C Corp) reported taxable income before the NOL deduction in the amount of $100,000 in 2020. Willow had an NOL carryover of $90,000 coming into 2020. Question 1 50 Points How much tax will Willow pay in 2020, what is the NOL carryover to 2021, and when will the NOL expire if $50,000 of the NOL was generated in 2016 and $40,000 of the NOL was generated in 2017. T Arr 5 67 Use the editor to format your answer Word count: 0 Question 2 50 Points How much tax will Willow pay in 2020, what is the NOL carryover to 2021, and when will the NOL expire if $50,000 of the NOL was generated in 2018 and $40,000 was generated in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts