Question: answer and show your solution Problem 17-14 (IAA) At the beginning of current year, Magic Company purchased 40% of the outstanding ordinary shares of an

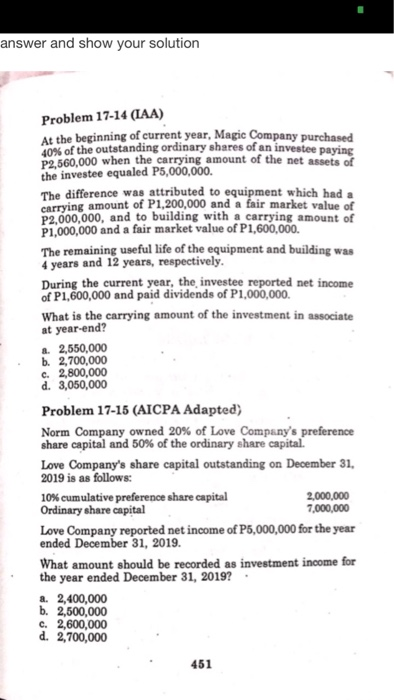

answer and show your solution Problem 17-14 (IAA) At the beginning of current year, Magic Company purchased 40% of the outstanding ordinary shares of an investee paying P.560,000 when the carrying amount of the net assets of the investee equaled P5,000,000. The difference was attributed to equipment which had a carrying amount of P1,200,000 and a fair market value of P2,000,000, and to building with a carrying amount of P1,000,000 and a fair market value of P1,600,000 The remaining useful life of the equipment and building was 4 years and 12 years, respectively During the current year, the investee reported net income of P1,600,000 and paid dividends of P1,000,000 What is the carrying amount of the investment in associate at year-end? 2,550,000 b. 2,700,000 c. 2,800,000 d. 3,050,000 Problem 17-15 (AICPA Adapted) Norm Company owned 20% of Love Company's preference share capital and 50% of the ordinary share capital Love Company's share capital outstanding on December 31, 2019 is as follows: 2000,000 7,000,000 10% cumulative preference share capital Ordinary share capital Love Company reported net income of P5,000,000 for the year ended December 31, 2019. What amount should be recorded as investment income for the year ended December 31, 2019? a. 2,400,000 b. 2,500,000 c. 2,600,000 d. 2,700,000 451

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts