Question: Answer and show your solution Problem 9-14 (AICPA Adapted) Vane Company provided the following information for the current year: Debit Credit Sales Cost of goods

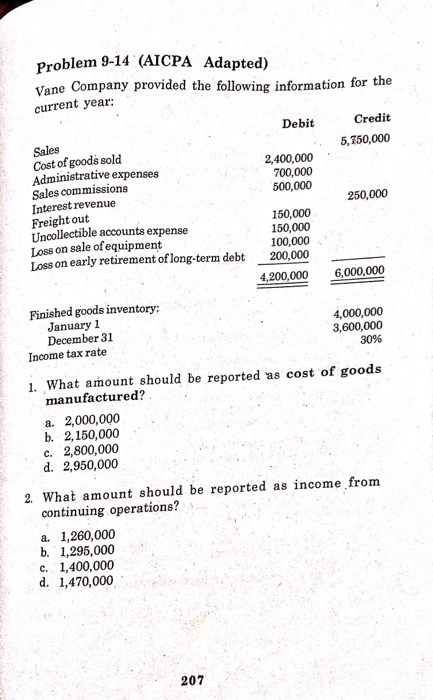

Problem 9-14 (AICPA Adapted) Vane Company provided the following information for the current year: Debit Credit Sales Cost of goods sold Administrative expenses Sales commissions Interest revenue Freight out Uncollectible accounts expense Loss on sale of equipment Loss on early retirement oflong-term debt 5,750,000 2,400,000 700,000 500,000 250,000 150,000 150,000 100,000 200,000 4,200,000 6,000,000 Finished goods inventory January 1 December 31 4,000,000 3,600,000 30% Income tax rate 1. What amount should be reported as cost of goods manufactured? a. 2,000,000 b. 2,150,000 c. 2,800,000 d. 2,950,000 2. What amount should be reported as income from continuing operations? a. 1,260,000 b. 1,295,000 c. 1,400,000 d. 1,470,000 207

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts