Question: Answer and show your work please ENN Inc. expects to earn $2 per share in year 1. The company has a policy of retaining 60

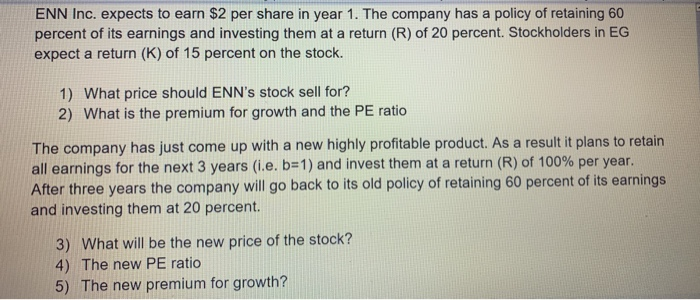

ENN Inc. expects to earn $2 per share in year 1. The company has a policy of retaining 60 percent of its earnings and investing them at a return (R) of 20 percent. Stockholders in EG expect a return (K) of 15 percent on the stock. 1) What price should ENN's stock sell for? 2) What is the premium for growth and the PE ratio The company has just come up with a new highly profitable product. As a result it plans to retain all earnings for the next 3 years (i.e. b=1) and invest them at a return (R) of 100% per year. After three years the company will go back to its old policy of retaining 60 percent of its earnings and investing them at 20 percent. 3) What will be the new price of the stock? 4) The new PE ratio 5) The new premium for growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts