Question: Answer any 4 questions. You are advised to be as analytical as possible in your answers 1 A. Ex plain the main theoretical underpinnings of

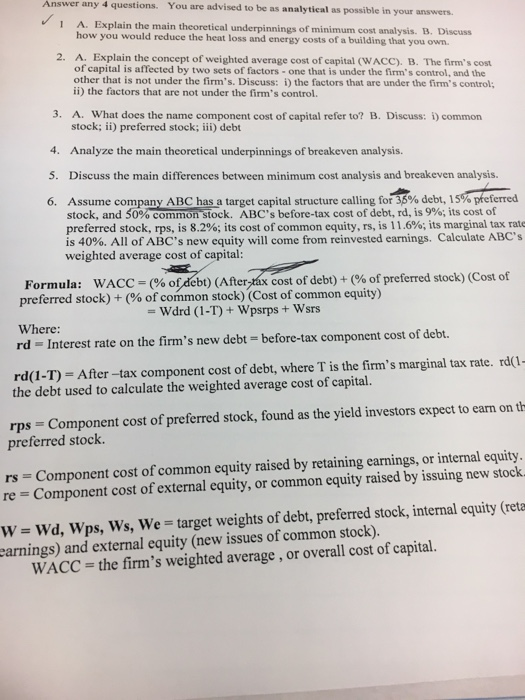

Answer any 4 questions. You are advised to be as analytical as possible in your answers 1 A. Ex plain the main theoretical underpinnings of minimum cost analysis. B. Discuss how you would reduce the heat loss and energy costs of a building that you own. A. Explain the concept of weighted average cost of capital (WACC). B. The firm's cost of capital is affected by two sets of factors- one that is under the firm's control, and the other that is not under the firm's. Discuss: i) the factors that are under the firm's control; ii) the factors that are not under the firm's control. 2. 3. A. What does the name component cost of capital refer to? B. Discuss: 1) common stock; ii) preferred stock; iii) debt Analyze the main theoretical underpinnings of breakeven analysis. Discuss the main differences between minimum cost analysis and breakeven analysis. 4. 5. 6. Assume compan> ABC has a target capital structure calling for 5% debt, 15% e erred stock, and 590 common stock. preferred stock, rps, is 8.2 %; its cost of common equity, rs, is 11.6%; its marginal tax rate is 40%. All of ABC's new equity will come from reinvested earnings. Calculate ABC's ABC's before-tax cost ofdebt, rd, is 9%; its cost of weighted average cost of capital: (% of preferred stock) (Cost of Formula: WACC = (% ofdebt) (After,tx cost of debt) + preferred stock) + (% of common stock) (Cost of common equity) Where: rd - Interest rate on the firm's new debt-before-tax component cost of debt. rd(I-T After-tax component cost of debt, where T is the firm's marginal tax rate. rd(l the debt used to calculate the weighted average cost of capital. rps -Component cost of preferred stock, found as the yield investors expect to earn on th preferred stock. rs Component cost of common equity raised by retaining earnings, or internal equity re Component cost of external equity, or common equity raised by issuing new stock W - Wd, Wps, Ws, We target weights of debt, preferred stock, internal equity (reta earnings) and external equity (new issues of common stock). the firm's weighted average, or overall cost of capital. WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts