Question: Answer any question goods sold is given by: Beginning inventory - net purchases + ending inventory Beginning inventory + accounts payable - net purchases Net

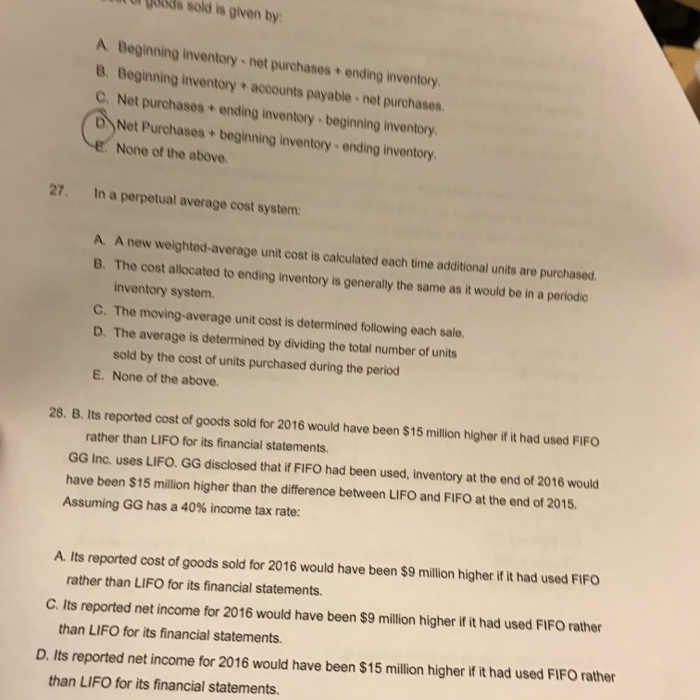

goods sold is given by: Beginning inventory - net purchases + ending inventory Beginning inventory + accounts payable - net purchases Net purchases + ending inventory - beginning inventory Net purchases + beginning inventory - ending inventory None of the above In a perpetual average cost system A now weighted-average unit cost is calculated each time additional units are purchased The cost allocated to ending inventory is generally the same as it would be in a periodic inventory system. The moving-average unit cost is determined following each sale The average is determined by dividing the total number of units sold by the cost of units purchased during the period None of the above. Its reported cost of goods sold for 2016 would have been $15 million higher if it had used FIFO rather than LIFO for its financial statements. GG Inc. uses LIFO. GG disclosed that if FIFO had been used, inventory at the end of 2016 would have been $15 million higher than the difference between LIFO and FIFO at the end of 2015. Assuming GG has a 40% income tax rate: Its reported cost of goods sold for 2016 would have been $9 million higher if it had used FIFO rather than LIFO for its financial statements. Its reported net income for 2016 would have been $9 million higher if it had used FIFO rather than LIFO for its financial statements Its reported net income for 2016 would have been $15 million higher if it had used FIFO rather than LIFO for its financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts