Question: Answer ANY two from questions 3-5! An additional question answered will not be graded. 3. Consider a one-period binomial world in which the current stock

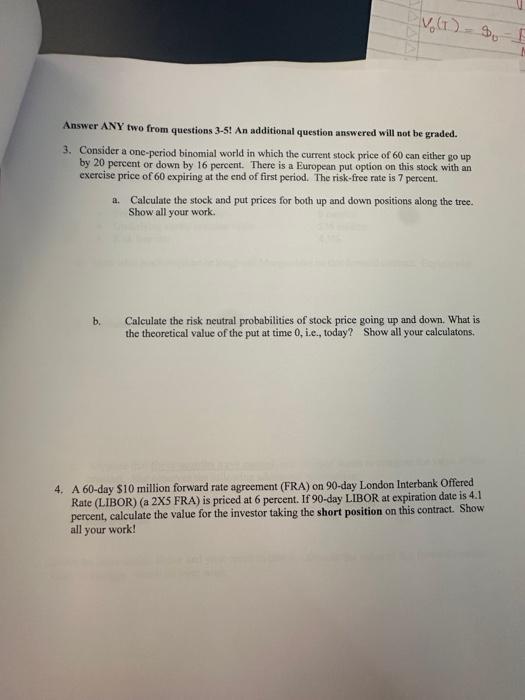

Answer ANY two from questions 3-5! An additional question answered will not be graded. 3. Consider a one-period binomial world in which the current stock price of 60 can either go up by 20 percent or down by 16 percent. There is a European put option on this stock with an exercise price of 60 expiring at the end of first period. The risk-free rate is 7 percent. a. Calculate the stock and put prices for both up and down positions along the tree. Show all your work. b. Calculate the risk neutral probabilities of stock price going up and down. What is the theoretical value of the put at time 0, i.e., today? Show all your calculatons. 4. A 60-day $10 million forward rate agreement (FRA) on 90-day London Interbank Offered Rate (LIBOR) (a 2X5 FRA) is priced at 6 percent. If 90-day LIBOR at expiration date is 4.1 percent, calculate the value for the investor taking the short position on this contract. Show all your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts