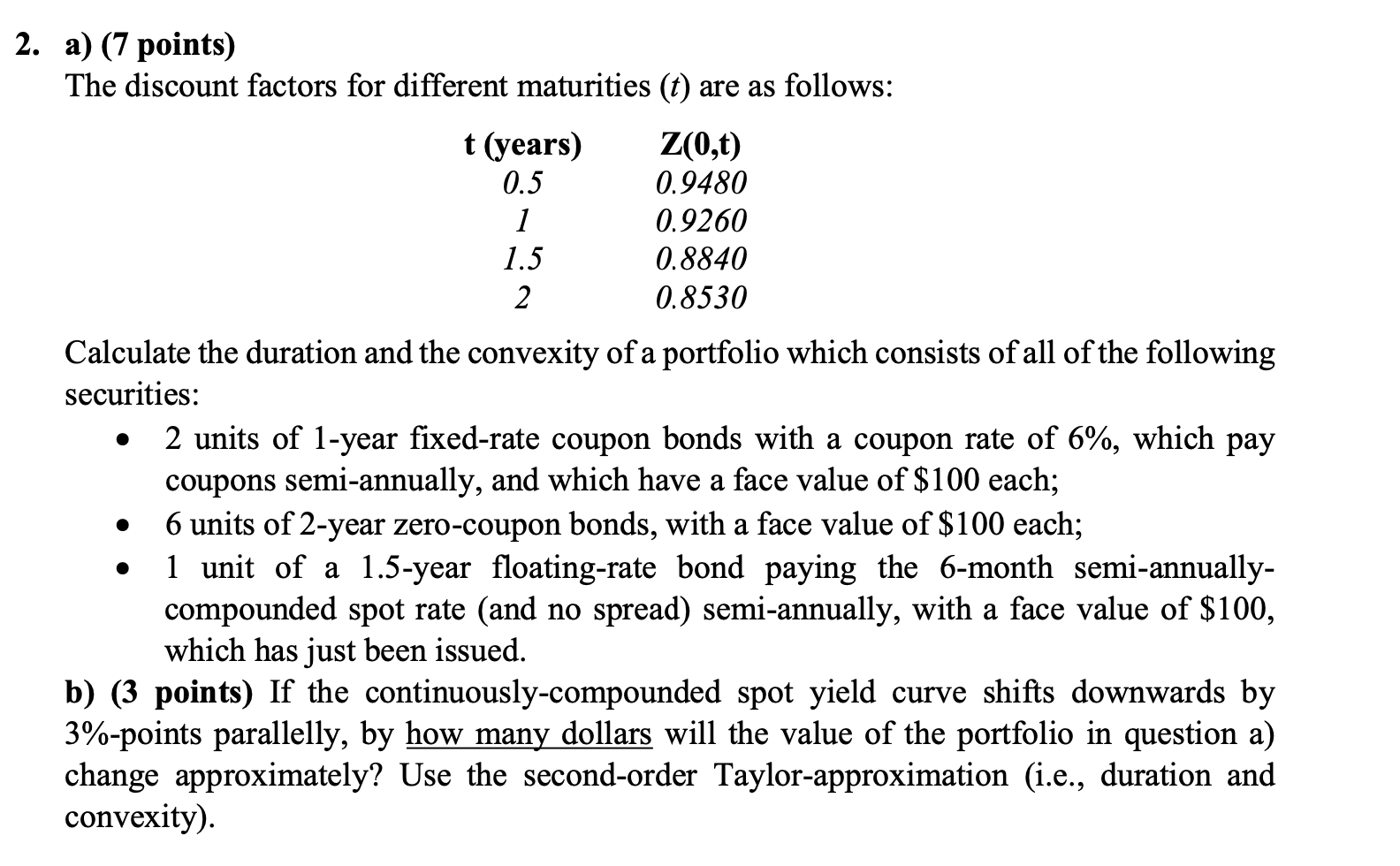

Question: Answer appropriately 2. a) (7 points) The discount factors for different maturities (t) are as follows: t (years) Z(0,t) 0.5 0.9480 1 0.9260 1.5 0.8840

Answer appropriately

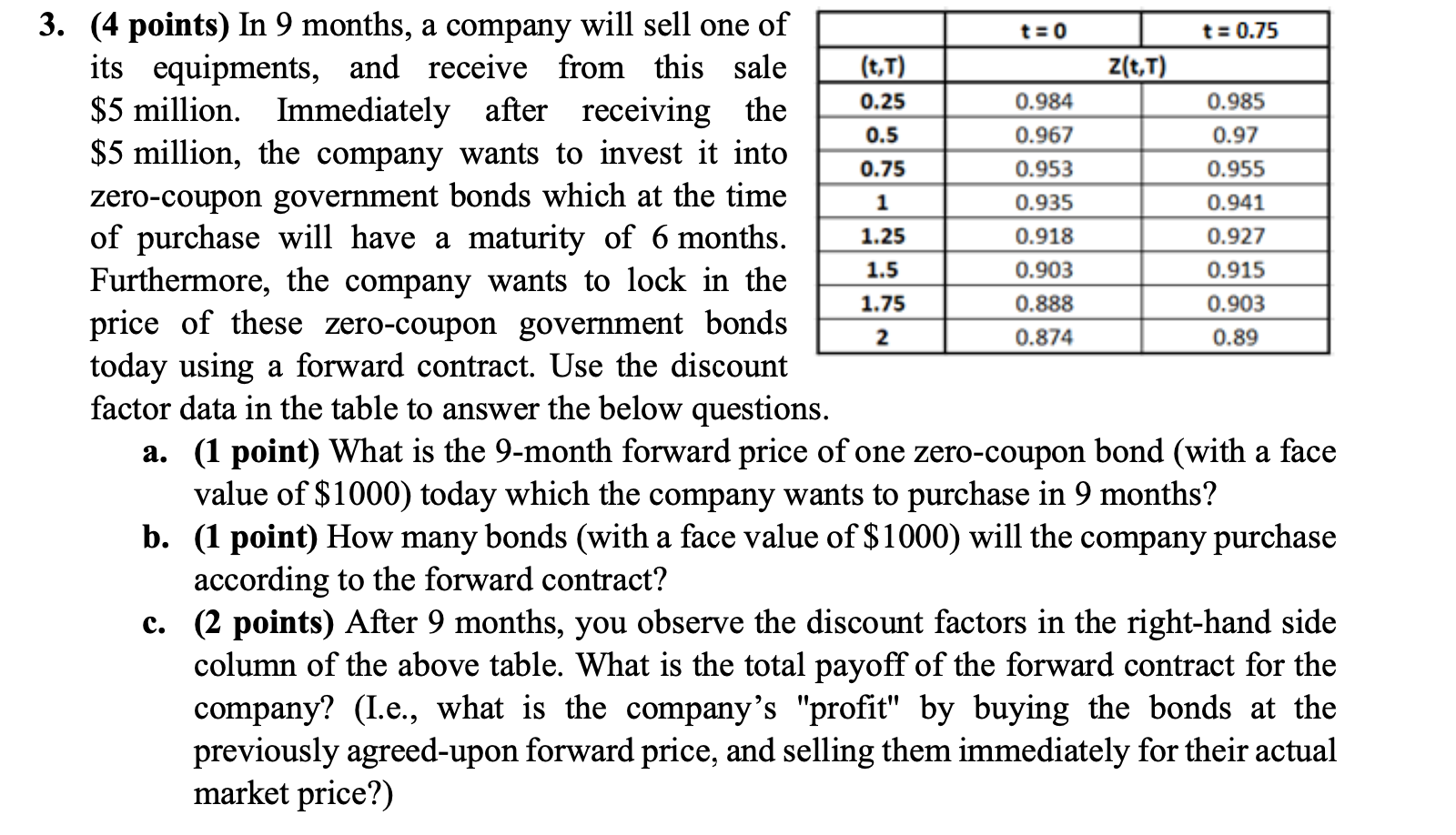

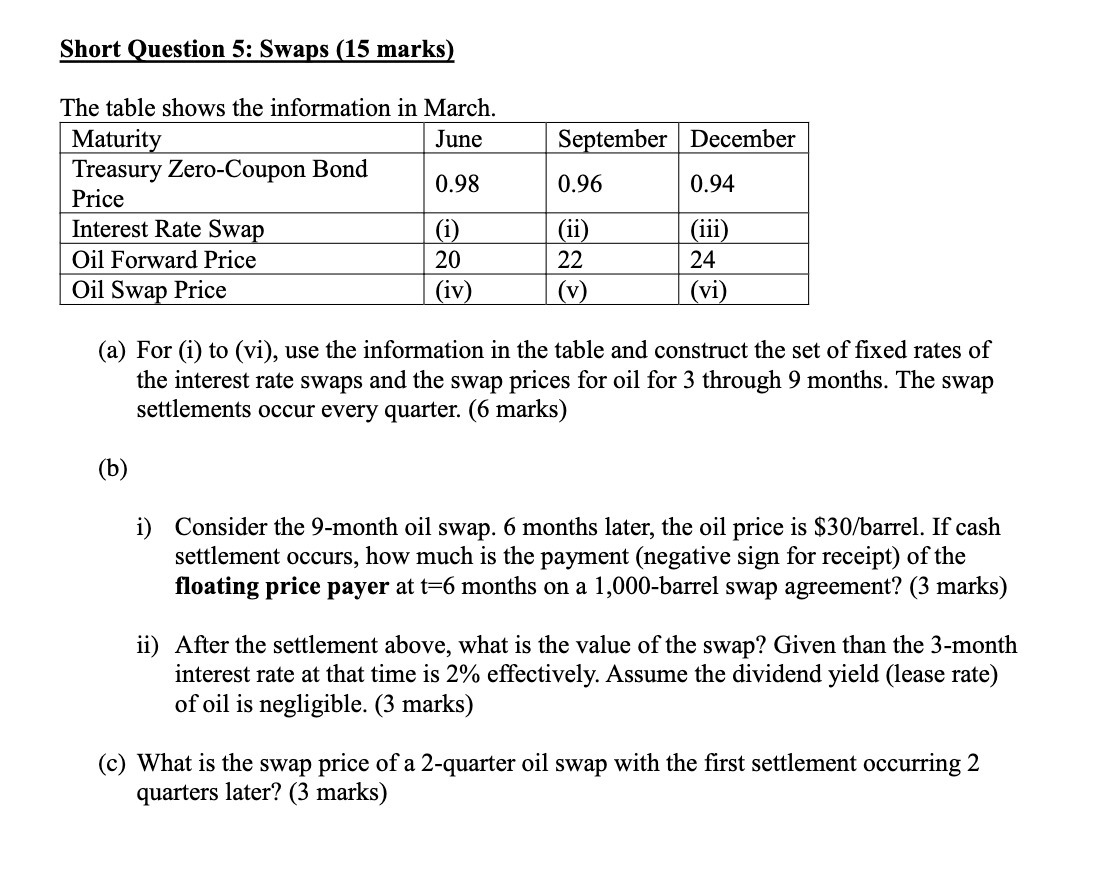

2. a) (7 points) The discount factors for different maturities (t) are as follows: t (years) Z(0,t) 0.5 0.9480 1 0.9260 1.5 0.8840 2 0.8530 Calculate the duration and the convexity of a portfolio which consists of all of the following securities: 2 units of 1-year fixed-rate coupon bonds with a coupon rate of 6%, which pay coupons semi-annually, and which have a face value of $100 each; . 6 units of 2-year zero-coupon bonds, with a face value of $100 each; 1 unit of a 1.5-year floating-rate bond paying the 6-month semi-annually- compounded spot rate (and no spread) semi-annually, with a face value of $100, which has just been issued. b) (3 points) If the continuously-compounded spot yield curve shifts downwards by 3%-points parallelly, by how many dollars will the value of the portfolio in question a) change approximately? Use the second-order Taylor-approximation (i.e., duration and convexity).3. (4 points) In 9 months, a company will sell one of its equipments, and receive from this sale $5 million. Immediately after receiving the $5 million, the company wants to invest it into zero-coupon government bonds which at the time of purchase will have a maturity of 6 months. Furthermore, the company wants to lock in the price of these zero-coupon government bonds today using a forward contract. Use the discount factor data in the table to answer the below questions. a. (1 point) What is the 9-month forward price of one zero-coupon bond (with a face value of $1000) today which the company wants to purchase in 9 months? b. (1 point) How many bonds (with a face value of $ 1000) will the company purchase according to the forward contract? c. (2 points) After 9 months, you observe the discount factors in the right-hand side column of the above table. What is the total payoff of the forward contract for the company? (I.e., what is the company's "prot" by buying the bonds at the previously agreed-upon forward price, and selling them immediately for their actual market price?) Short Question 5: Swaps (15 marks) The table shows the information in March. Maturi June S ntember December Treasury Zero-Coupon Bond -M 0.94 Price Interest Rate Swap (i) (iii) Oil Forward Price 2 22 24 Oil Swap Price (iv) (v) (vi) (a) For (i) to (vi), use the information in the table and construct the set of xed rates of the interest rate swaps and the swap prices for oil for 3 through 9 months. The swap settlements occur every quarter. (6 marks) (b) i) Consider the 9-month oil swap. 6 months later, the oil price is $30/barrel. If cash settlement occurs, how much is the payment (negative Sign for receipt) of the oating price payer at t=6 months on a LOGObarrel swap agreement? (3 marks) ii) After the settlement above, what is the value of the swap? Given than the 3-month interest rate at that time is 2% effectively. Assume the dividend yield (lease rate) of oil is negligible. (3 marks) (0) What is the swap price of a 2-quarter oil swap with the rst settlement occurring 2 quarters later