Question: answer as many as possible please! Question 1 4 pts Amarillo Associates has a debt ratio of 50 percent, a total asset turnover ratio of

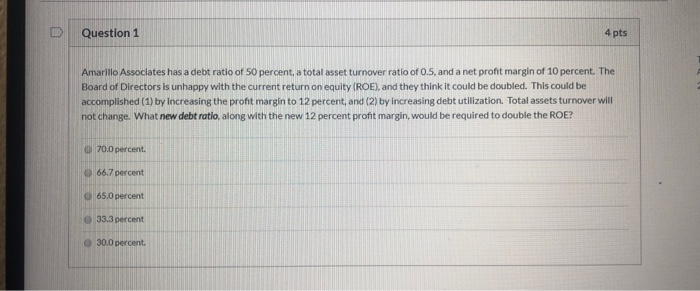

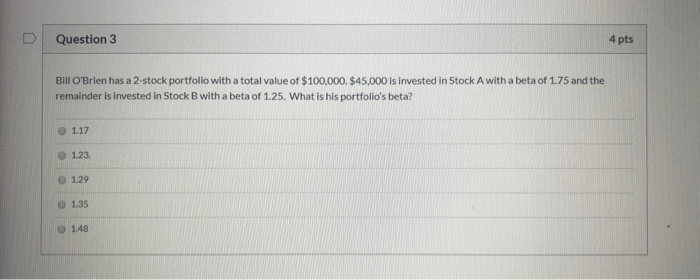

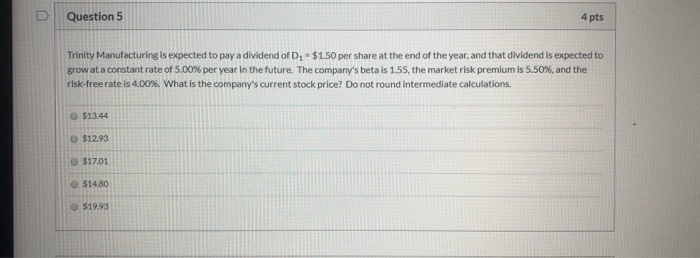

Question 1 4 pts Amarillo Associates has a debt ratio of 50 percent, a total asset turnover ratio of 0.5, and a net profit margin of 10 percent. The Board of Directors is unhappy with the current return on equity (ROE), and they think it could be doubled. This could be accomplished (1) by increasing the profit margin to 12 percent, and (2) by increasing debt utilization. Total assets turnover will not change. What new debt ratio, along with the new 12 percent profit margin, would be required to double the ROE? O 70.0 percent. 66.7 percent 65.0 percent 33.3 percent 30.0 percent Question 3 4 pts Bill O'Brien has a 2-stock portfolio with a total value of $100,000. $45,000 is invested in Stock A with a beta of 1.75 and the remainder is invested in Stock B with a beta of 1.25. What is his portfolio's beta? 01.17 1.23 1.29 135 148 Question 5 4 pts Trinity Manufacturing is expected to pay a dividend of D, - $1.50 per share at the end of the year, and that dividend is expected to grow at a constant rate of 5.00% per year in the future. The company's beta is 1.55, the market risk premium is 5.50%, and the risk-free rate is 4.00%. What is the company's current stock price? Do not round intermediate calculations. $13.44 $12.93 $17.01 $14.80 $19.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts