Question: answer as many as possible please! Question 10 4 pts Calculate the EBIT (Earnings before Interest and Taxes) for a firm with $2,500,000 total revenues

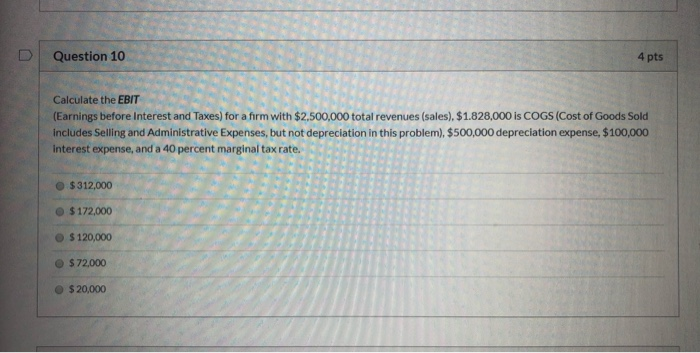

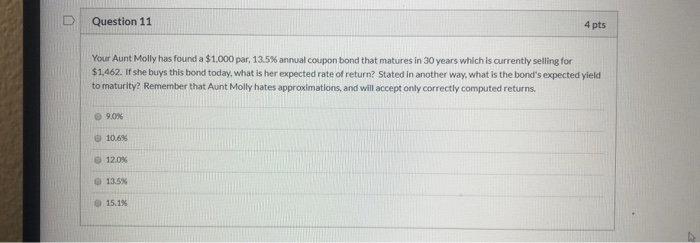

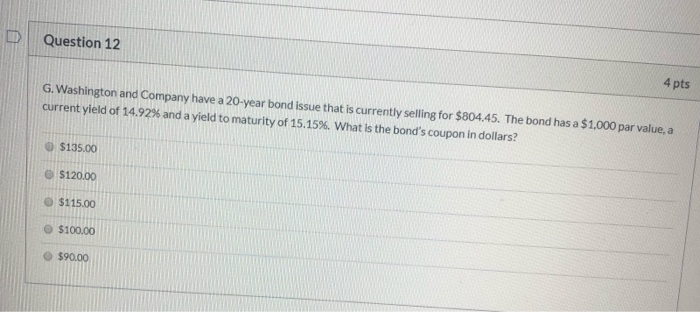

Question 10 4 pts Calculate the EBIT (Earnings before Interest and Taxes) for a firm with $2,500,000 total revenues (sales) $1.828,000 is COGS (Cost of Goods Sold includes Selling and Administrative Expenses, but not depreciation in this problem), $500,000 depreciation expense, $100,000 interest expense, and a 40 percent marginal tax rate. $312,000 $ 172,000 $ 120,000 $72,000 $ 20,000 Question 11 4 pts Your Aunt Molly has found a $1.000 par, 13.5% annual coupon bond that matures in 30 years which is currently selling for $1,462. If she buys this bond today, what is her expected rate of return? Stated in another way, what is the bond's expected yield to maturity? Remember that Aunt Molly hates approximations, and will accept only correctly computed returns. 9.0% O 10.6% 12.0% 13.5% 15.1% D Question 12 4 pts G. Washington and Company have a 20-year bond issue that is currently selling for $804.45. The bond has a $1,000 par value, a current yield of 14.92% and a yield to maturity of 15.15%. What is the bond's coupon in dollars? O $135.00 $120.00 $115.00 $100.00 $90.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts