Question: Answer as soon as possible please! :) I'll give good feedback Regina Company operates a small manufacturing facility as a supplement to its regular service

Answer as soon as possible please! :) I'll give good feedback

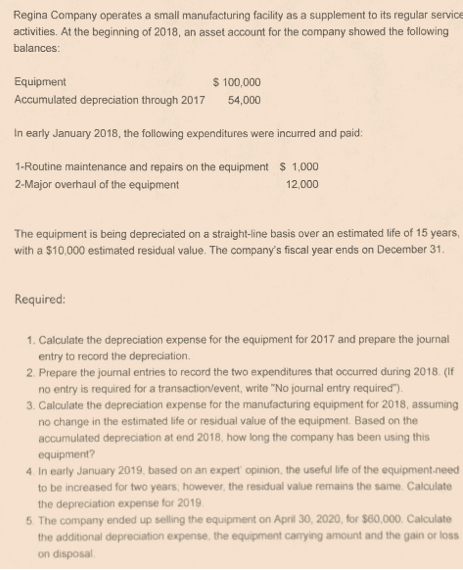

Regina Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of 2018, an asset account for the company showed the following balances: Equipment Accumulated depreciation through 2017 $ 100,000 54,000 In early January 2018, the following expenditures were incurred and paid: 1-Routine maintenance and repairs on the equipment $ 1,000 2-Major overhaul of the equipment 12,000 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years, with a $10,000 estimated residual value. The company's fiscal year ends on December 31. Required: 1. Calculate the depreciation expense for the equipment for 2017 and prepare the journal entry to record the depreciation. 2. Prepare the journal entries to record the two expenditures that occurred during 2018. (If no entry is required for a transaction/event, write "No journal entry required) 3. Calculate the depreciation expense for the manufacturing equipment for 2018, assuming no change in the estimated life or residual value of the equipment. Based on the accumulated depreciation at end 2018, how long the company has been using this equipment? 4. In early January 2019, based on an expert opinion, the useful life of the equipment need to be increased for two years, however, the residual value remains the same. Calculate the depreciation expense for 2019. 5. The company ended up selling the equipment on April 30, 2020, for $60,000. Calculate the additional depreciation expense, the equipment carrying amount and the gain or loss on disposal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts