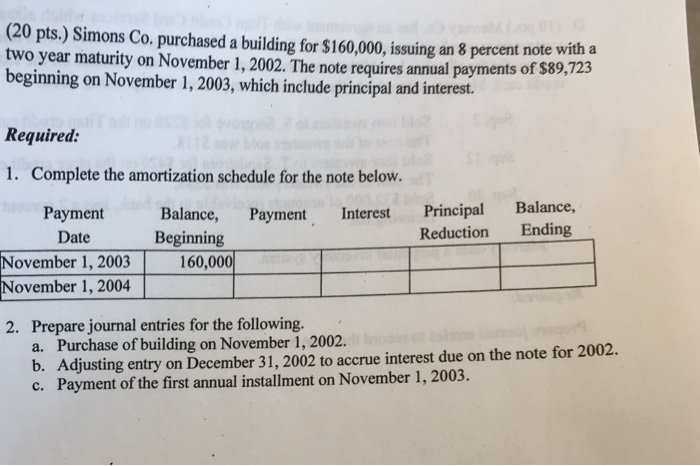

Question: Answer ASAP (20 pts.) Simons Co. purchased a building for $160,000, issuing an 8 percent note with a two year maturity on November 1, 2002.

(20 pts.) Simons Co. purchased a building for $160,000, issuing an 8 percent note with a two year maturity on November 1, 2002. The note requires annual payments of S8 beginning on November 1, 2003, which include principal and interest. 9,723 Required: 1. Complete the amortization schedule for the note below. Payment Date Balance, Payment Interest Principal Balance, Beginning Reduction Ending . November 1, 2003160,000 November 1, 2004 Prepare journal entries for the following. a. Purchase of building on November 1, 2002. b. Adjusting entry on December 31, 2002 to accrue interest due on the note for 2002 c. Payment of the first annual installment on November 1, 2003. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts