Question: ANSWER ASAP! 23) PDF Corp. needs to replace an old lathe with a new, more efficient model. The old lathe was purchased for $50,000 nine

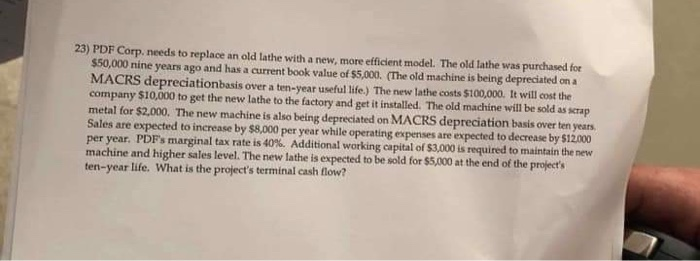

23) PDF Corp. needs to replace an old lathe with a new, more efficient model. The old lathe was purchased for $50,000 nine years ago and has a current book value of $5.000. (The old machine is being depreciated on a MACRS depreciationbasis over a ten-year useful life. The new lathe costs $100,000. It will cost the company $10,000 to get the new lathe to the factory and get it installed. The old machine will be sold as scrap metal for $2,000. The new machine is also being depreciated on MACRS depreciation basis over ten years. Sales are expected to increase by $8,000 per year while operating expenses are expected to decrease by $12.000 per year. PDF's marginal tax rate is 40%. Additional working capital of $3,000 is required to maintain the new machine and higher sales level. The new lathe is expected to be sold for 55.000 at the end of the project's ten-year life. What is the project's terminal cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts