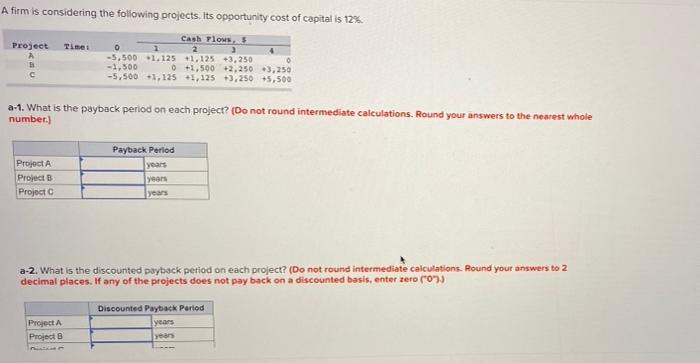

Question: (ANSWER ASAP) A firm is considering the following projects. its opportunity cost of capital is 12% A firm is considering the following projects. Its opportunity

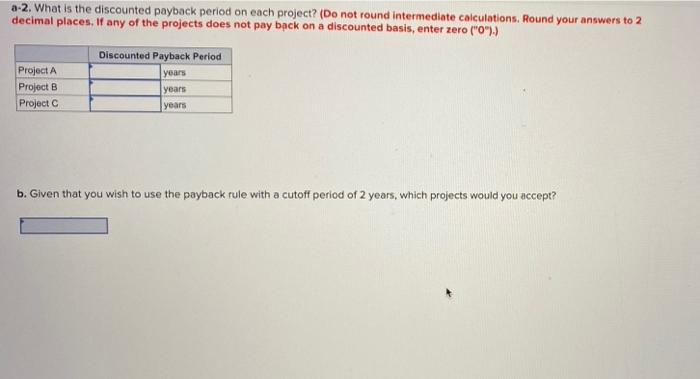

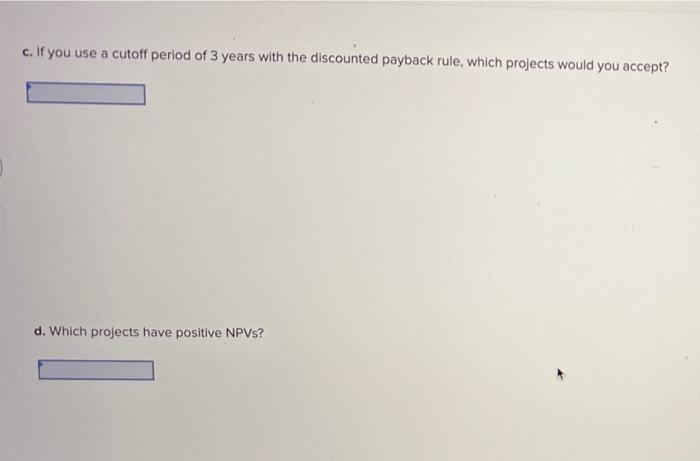

A firm is considering the following projects. Its opportunity cost of capital is 12% Project Time: Cash Flows, 2 4 -5,500 1.125 1.125 +3,250 . - 1,500 0 +1,500 +2.250 +3,250 -5,500 +1,125 +1,125 +3,250 +5,500 c a-1. What is the payback period on each project? (Do not round intermediate calculations. Round your answers to the nearest whole number.) Payback Period years Project A Project B Project years years a-2. What is the discounted payback period on each project? (Do not round intermediate calculations. Round your answers to 2 decimal places. If any of the projects does not pay back on a discounted basis, enter zero (0 Project A Project B Discounted Payback Period years year a-2. What is the discounted payback period on each project? (Do not round intermediate calculations. Round your answers to 2 decimal places. If any of the projects does not pay back on a discounted basis, enter zero ("O").) Project A Project B Project Discounted Payback Period years years years b. Given that you wish to use the payback rule with a cutoff period of 2 years, which projects would you accept? c. If you use a cutoff period of 3 years with the discounted payback rule, which projects would you accept? d. Which projects have positive NPVS? e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts