Question: ANSWER ASAP IT IS AN EXAM AND THE TIME IS LESS QUESTION 3 (2013ZB Q3a) ABC Corporation is considering acquiring XYZ Corporation. You have the

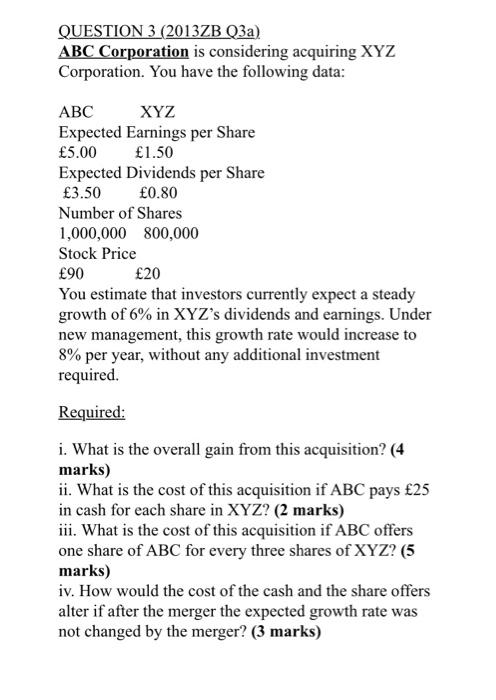

QUESTION 3 (2013ZB Q3a) ABC Corporation is considering acquiring XYZ Corporation. You have the following data: ABC XYZ Expected Earnings per Share 5.00 1.50 Expected Dividends per Share 3.50 0.80 Number of Shares 1,000,000 800,000 Stock Price 90 20 You estimate that investors currently expect a steady growth of 6% in XYZ's dividends and earnings. Under new management, this growth rate would increase to 8% per year, without any additional investment required. Required: i. What is the overall gain from this acquisition? (4 marks) ii. What is the cost of this acquisition if ABC pays 25 in cash for each share in XYZ? (2 marks) iii. What is the cost of this acquisition if ABC offers one share of ABC for every three shares of XYZ? (5 marks) iv. How would the cost of the cash and the share offers alter if after the merger the expected growth rate was not changed by the merger? (3 marks) QUESTION 3 (2013ZB Q3a) ABC Corporation is considering acquiring XYZ Corporation. You have the following data: ABC XYZ Expected Earnings per Share 5.00 1.50 Expected Dividends per Share 3.50 0.80 Number of Shares 1,000,000 800,000 Stock Price 90 20 You estimate that investors currently expect a steady growth of 6% in XYZ's dividends and earnings. Under new management, this growth rate would increase to 8% per year, without any additional investment required. Required: i. What is the overall gain from this acquisition? (4 marks) ii. What is the cost of this acquisition if ABC pays 25 in cash for each share in XYZ? (2 marks) iii. What is the cost of this acquisition if ABC offers one share of ABC for every three shares of XYZ? (5 marks) iv. How would the cost of the cash and the share offers alter if after the merger the expected growth rate was not changed by the merger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts