Question: answer asap no excel solutions QUESTION 3 (a) You purchased one of IUW's 20-year bond that pays coupons of 8%. The bond's YTM at purchase

answer asap no excel solutions

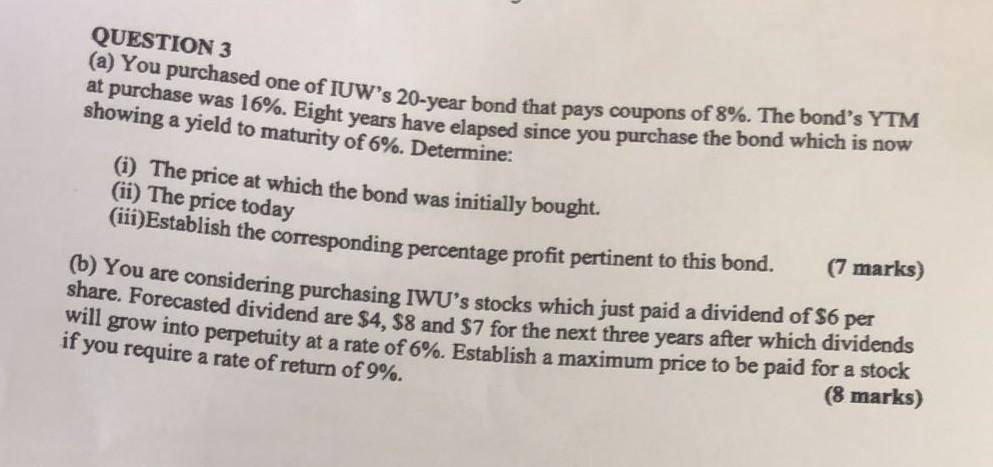

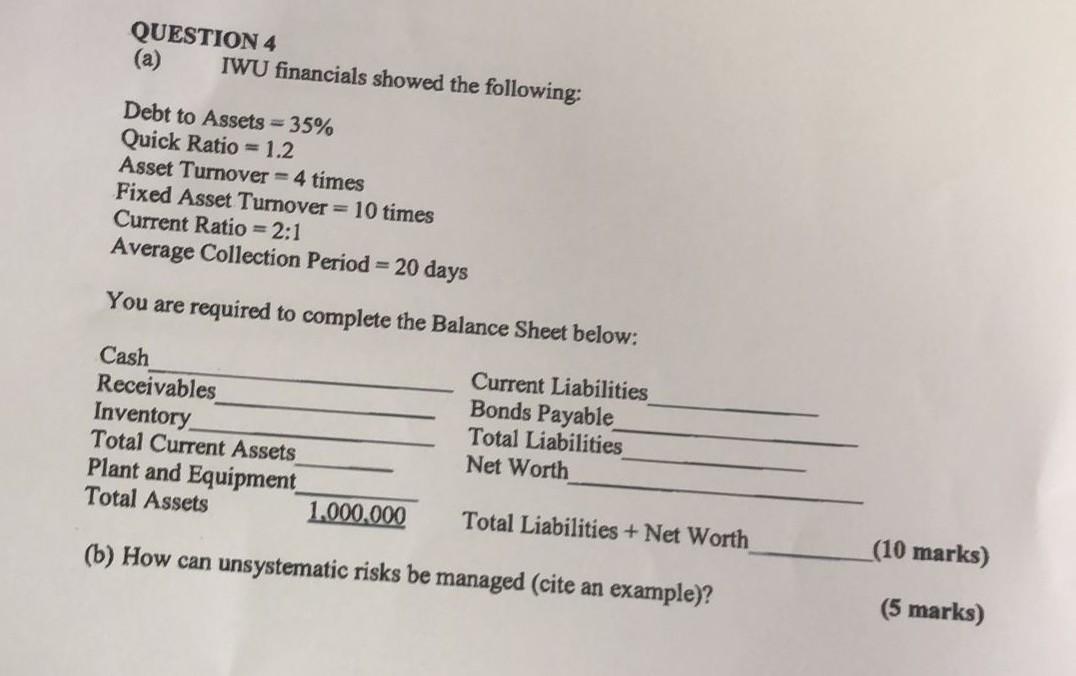

QUESTION 3 (a) You purchased one of IUW's 20-year bond that pays coupons of 8%. The bond's YTM at purchase was 16%. Eight years have elapsed since you purchase the bond which is now showing a yield to maturity of 6%. Determine: (1) The price at which the bond was initially bought. (ii) The price today (iii)Establish the corresponding percentage profit pertinent to this bond. (7 marks) (6) You are considering purchasing IWU's stocks which just paid a dividend of $6 per share. Forecasted dividend are $4,88 and $7 for the next three years after which dividends will grow into perpetuity at a rate of 6%. Establish a maximum price to be paid for a stock if you require a rate of return of 9%. (8 marks) QUESTION 4 (a) IWU financials showed the following: Debt to Assets = 35% Quick Ratio = 1.2 Asset Turnover = 4 times Fixed Asset Turnover = 10 times Current Ratio = 2:1 Average Collection Period = 20 days You are required to complete the Balance Sheet below: Cash Receivables Inventory Total Current Assets Plant and Equipment Total Assets 1.000.000 Current Liabilities Bonds Payable Total Liabilities Net Worth Total Liabilities + Net Worth (b) How can unsystematic risks be managed (cite an example)? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts