Question: ANSWER ASAP PLEASE AND THANK YOU. Listed below are the long-lived assets of a company. The company uses the straight-line method to determine depreciation expense.

ANSWER ASAP PLEASE AND THANK YOU.

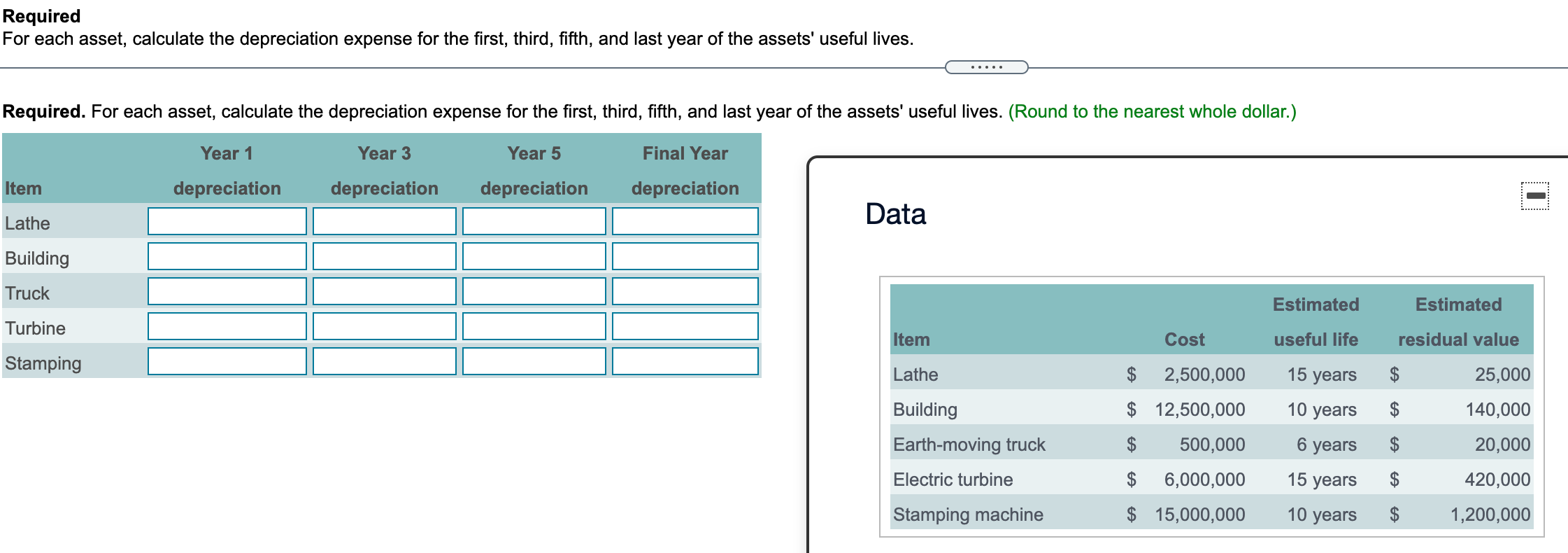

Listed below are the long-lived assets of a company. The company uses the straight-line method to determine depreciation expense. Assume in all cases that the asset's first and last years are full years and that all assumptions and estimates used to derive depreciation remain unchanged throughout the assets' useful lives.

Required For each asset, calculate the depreciation expense for the first, third, fifth, and last year of the assets' useful lives. Required. For each asset, calculate the depreciation expense for the first, third, fifth, and last year of the assets' useful lives. (Round to the nearest whole dollar.) Year 1 Year 3 Year 5 Final Year Item depreciation depreciation depreciation depreciation Data Lathe Building Truck Estimated Estimated Turbine Item Cost useful life residual value Stamping Lathe $ 2,500,000 15 years $ 25,000 $ 12,500,000 10 years 140,000 $ 6 years $ Building Earth-moving truck Electric turbine Stamping machine $ $ $ 20,000 500,000 6,000,000 15 years 420,000 $ 15,000,000 10 years $ 1,200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts