Question: ANSWER ASAP PLEASE. BUT MAKE SURE ANSWER IS CORRECT. thumbs up if right. KAL and Beoing. Korean Airines (KAL) has just signed a contract wat

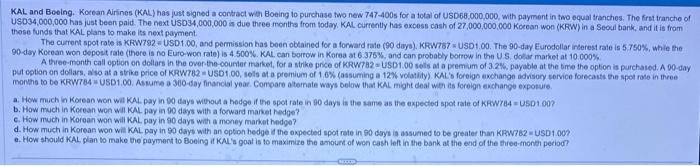

KAL and Beoing. Korean Airines (KAL) has just signed a contract wat Boeing to purchase two newi 7474005 for a total of USD68.000,000, with payment in two equal tranches. The frst tranche of Us034,000,000 has just been paid. The next USO34,000,000 is due three montha from loday. KAL curreetly has excoss cosh of 27,000,000,000Kocean won (KRW) in a Se0ul bank, and it is from those funds that KAL plans to make its next payment. 90-day Kocean woe depoet rale (thore is no Euro-woe rate) is 4.500%. KAL. can borrow in Korea at 6.376%, and can probaby borrew in the US. dotar market at 10.000% A thee-month call eption on dellars in the over the-counter market, for a strike pnce of KRWTa2 = USD1.00 sels at a premium of 3.24 , payablo at the bire the option is purchaied. A 00-day put eption on delars, ass at a strike price of KRWre2 = USD 1.00 , sols at a premium of 1.6% (assuming a 12% volatily). KAL's foreign exchango advisogy service forecaits the spot rase in thee monthe to be KFWTB4 = USD 1.00. Assume a 300 day financial year. Compare oternate ways below that KAL might deal wer its fereign exchange expoture. a. How much in Korean won wat KAL pay in 00 days withou a hodge if the spot rate in 90 days is the same as the expected spot rate of KFW7a4 = USD1 00 ? b. How much in Kerean won wil KAL, pay in 90 days with a forward manet hedge? c. How much in Korean won will KAL, pay in 90 days wht a money market hedge? d. How much in Korean won wili KAL pay in 90 days with an option hedge it the oxpected spot rate in 90 doye is assumed to be greater than KRW7E2 = USD1 00 ? a. How should KAL plan to make the payment to Boeing if KAl's goal is to maximize the arourt of won cash left in the bank at the end of the three-monet peciod

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts