Question: answer asap please Call Options - Suppose that you are a speculator that anticipates an appreciation of the Singapore dollar (S$). You purchase a call

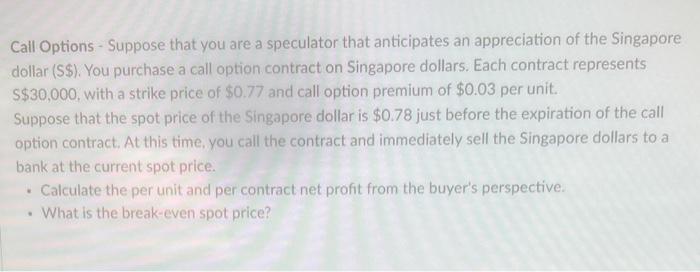

Call Options - Suppose that you are a speculator that anticipates an appreciation of the Singapore dollar (S\$). You purchase a call option contract on Singapore dollars. Each contract represents $30,000, with a strike price of $0.77 and call option premium of $0.03 per unit. Suppose that the spot price of the Singapore dollar is $0.78 just before the expiration of the call option contract. At this time, you call the contract and immediately sell the Singapore dollars to a bank at the current spot price. - Calculate the per unit and per contract net profit from the buyer's perspective. - What is the break-even spot price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts