Question: answer asap please. i will rate Use the following information on states of the economy and stock returns to calculate the standard deviation of returns.

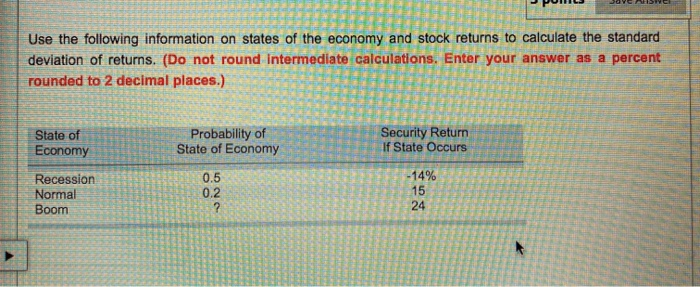

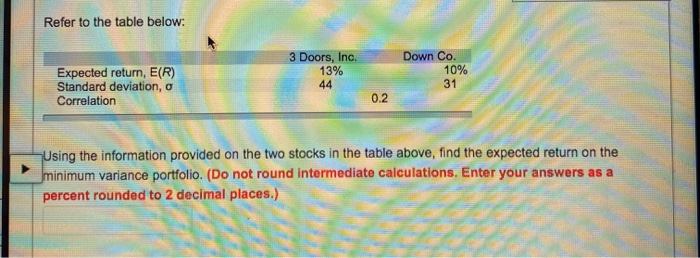

Use the following information on states of the economy and stock returns to calculate the standard deviation of returns. (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) State of Economy Probability of State of Economy Security Return If State Occurs Recession Normal Boom 0.5 0.2 -14% 15 24 Refer to the table below: Expected return, E(R) Standard deviation, o Correlation 3 Doors, Inc. 13% 44 Down Co. 10% 31 0.2 Using the information provided on the two stocks in the table above, find the expected return on the minimum variance portfolio. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts