Question: . Answer ASAP Please!!!:) Tharaldson Corporation makes a product with the following standard costs: Direct materials $ 3.00 per Standard Quantity Standard Price or Standard

.

.

Answer ASAP Please!!!:)

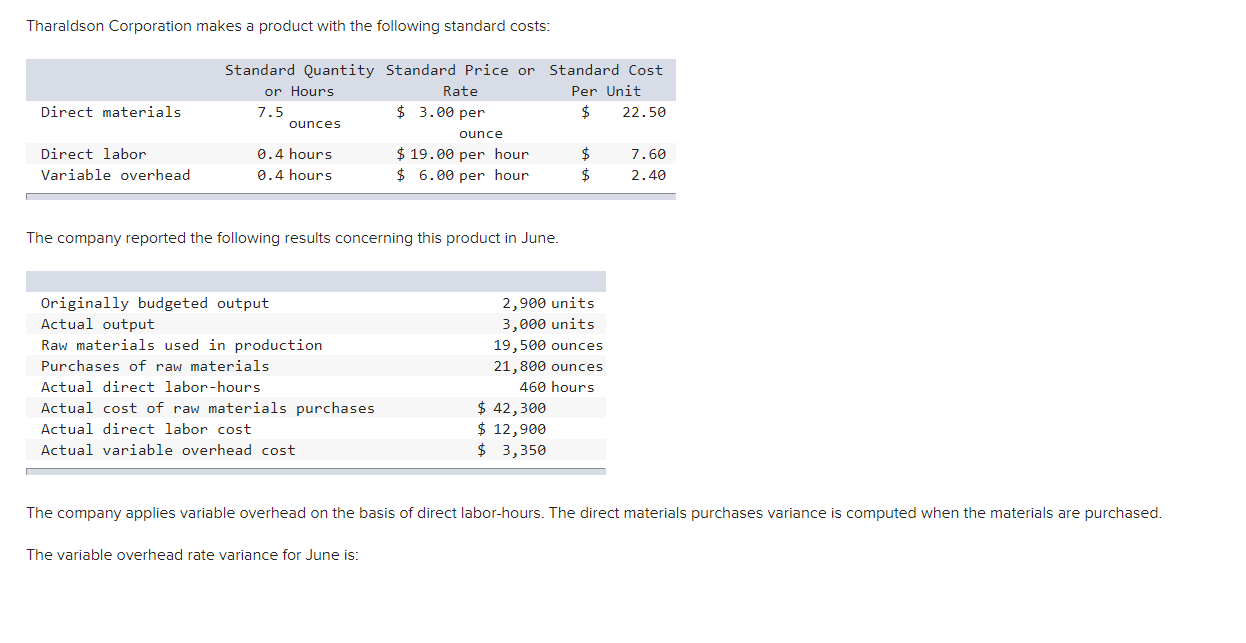

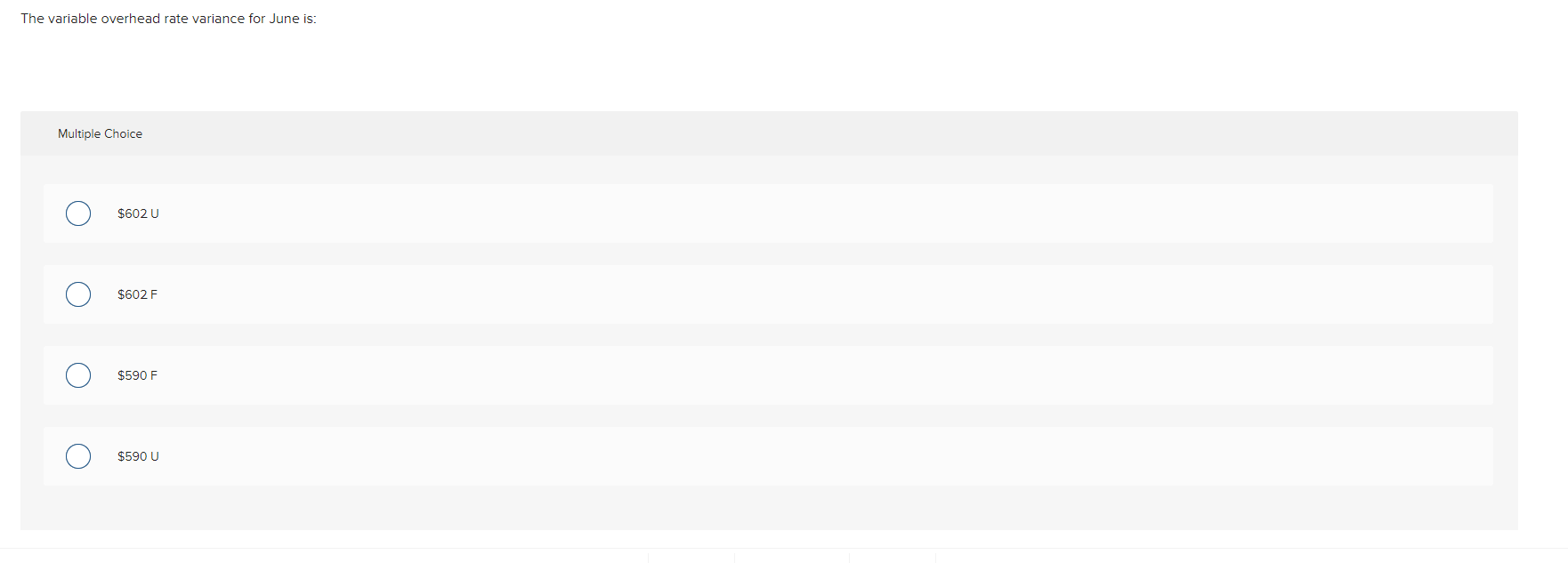

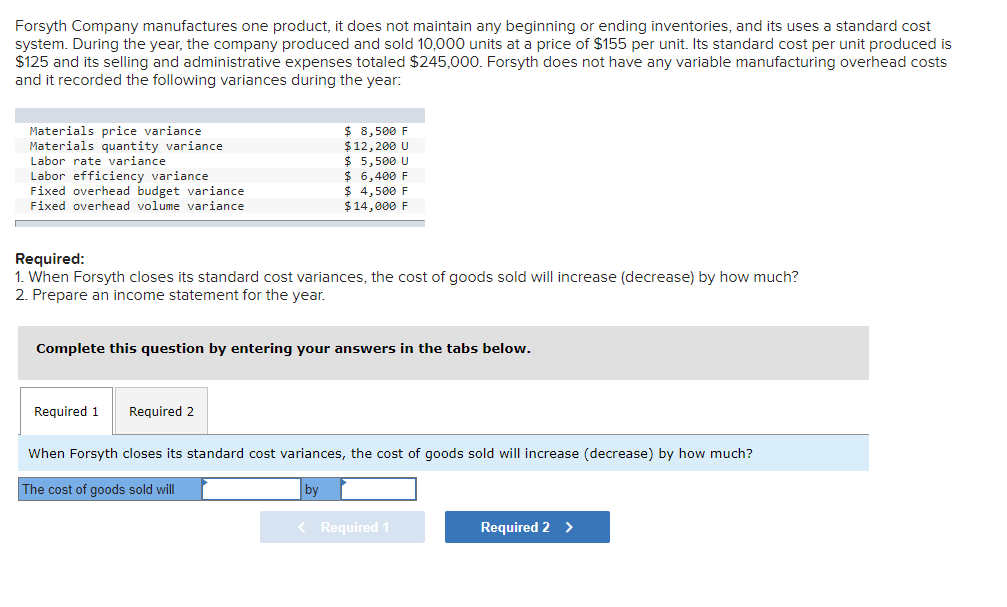

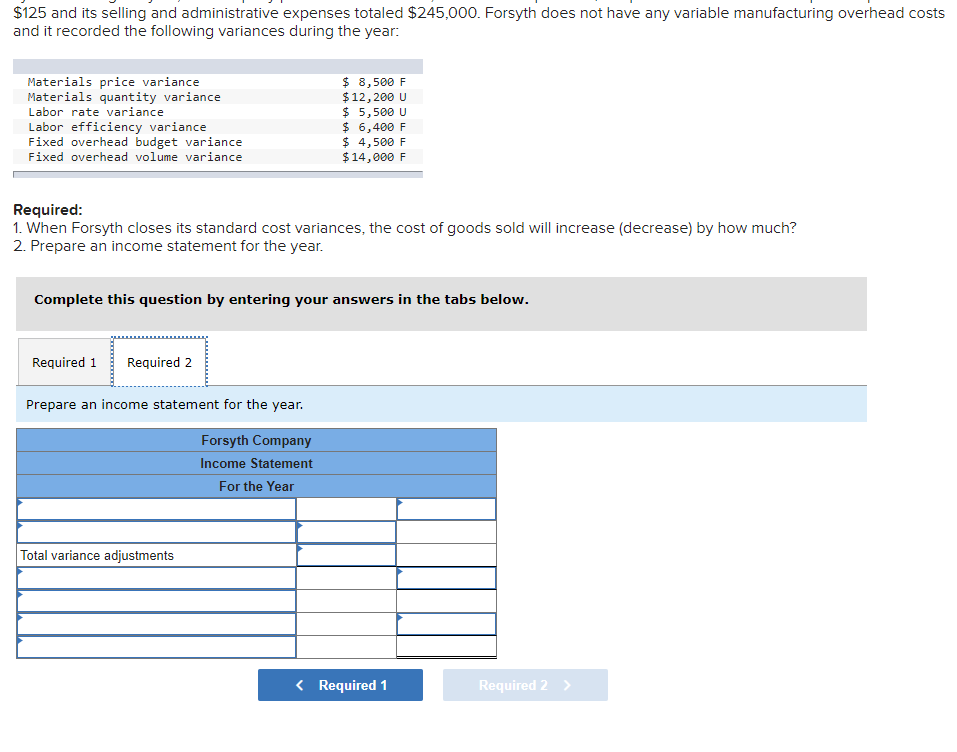

Tharaldson Corporation makes a product with the following standard costs: Direct materials $ 3.00 per Standard Quantity Standard Price or Standard Cost or Hours Rate Per Unit 7.5 $ 22.50 ounces ounce 0.4 hours $ 19.00 per hour $ 7.60 0.4 hours $ 6.00 per hour $ 2.40 Direct labor Variable overhead The company reported the following results concerning this product in June. Originally budgeted output Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost 2,900 units 3,000 units 19,500 ounces 21,800 ounces 460 hours $ 42,300 $ 12,900 $ 3,350 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for June is: The variable overhead rate variance for June is: Multiple Choice $602 U O $602 F O $590 F O O $590 U Forsyth Company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. During the year, the company produced and sold 10,000 units at a price of $155 per unit. Its standard cost per unit produced is $125 and its selling and administrative expenses totaled $245,000. Forsyth does not have any variable manufacturing overhead costs and it recorded the following variances during the year: Materials price variance Materials quantity variance Labor rate variance Labor efficiency variance Fixed overhead budget variance Fixed overhead volume variance $ 8,500 F $12,200 U $ 5,500 U $ 6,400 F $ 4,500 F $14,000 F Required: 1. When Forsyth closes its standard cost variances, the cost of goods sold will increase (decrease) by how much? 2. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 When Forsyth closes its standard cost variances, the cost of goods sold will increase (decrease) by how much? The cost of goods sold will by $125 and its selling and administrative expenses totaled $245,000. Forsyth does not have any variable manufacturing overhead costs and it recorded the following variances during the year: Materials price variance Materials quantity variance Labor rate variance Labor efficiency variance Fixed overhead budget variance Fixed overhead volume variance $ 8,500 F $12,200 u $ 5,500 U $ 6,400 F $ 4,500 F $14,000 F Required: 1. When Forsyth closes its standard cost variances, the cost of goods sold will increase (decrease) by how much? 2. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year. Forsyth Company Income Statement For the Year Total variance adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts