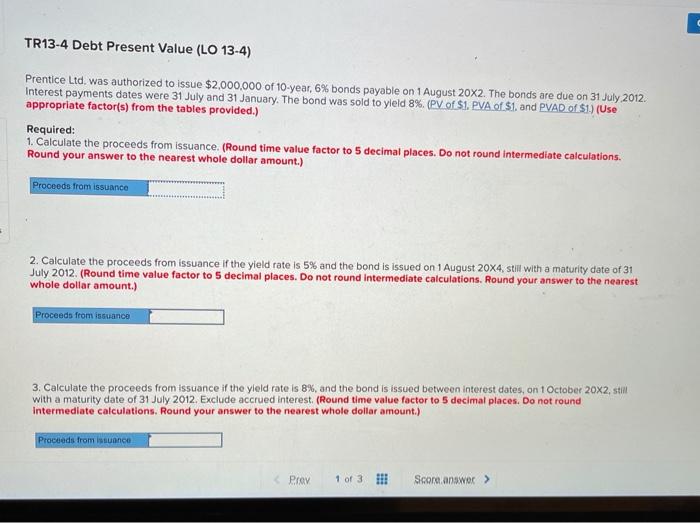

Question: answer asap please TR13-4 Debt Present Value (LO 13-4) Prentice Ltd. was authorized to issue $2,000,000 of 10-year, 6% bonds payable on 1 August 20x2.

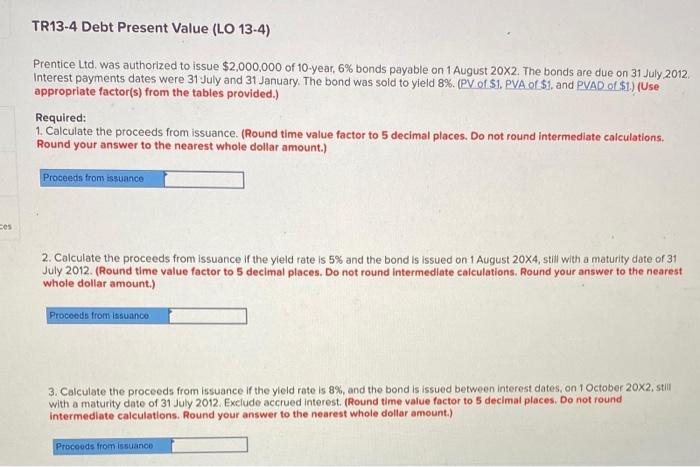

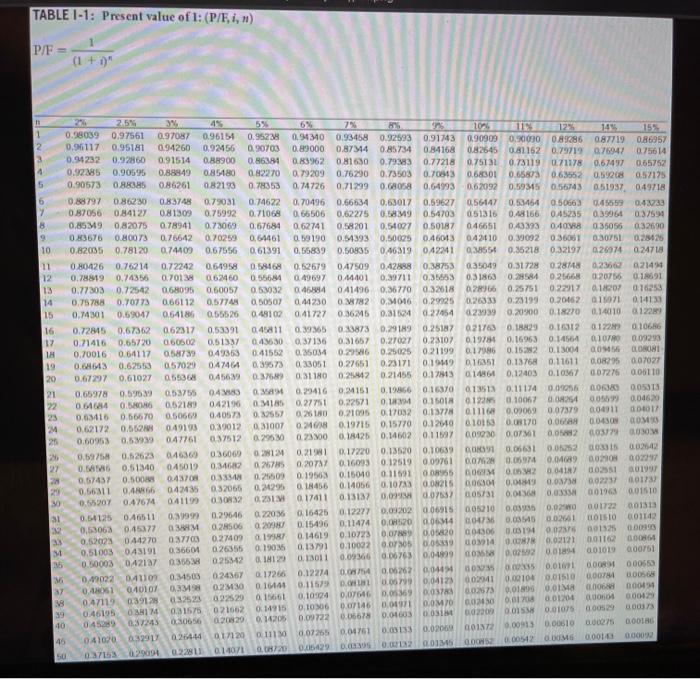

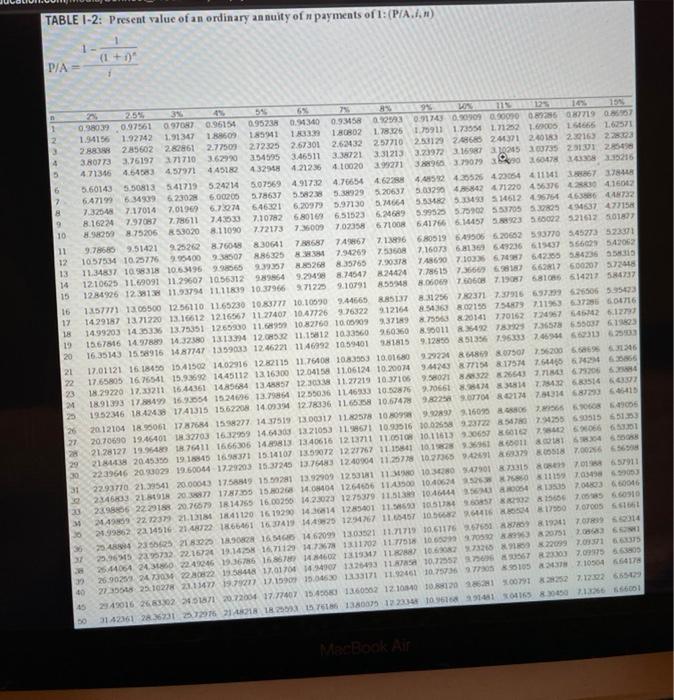

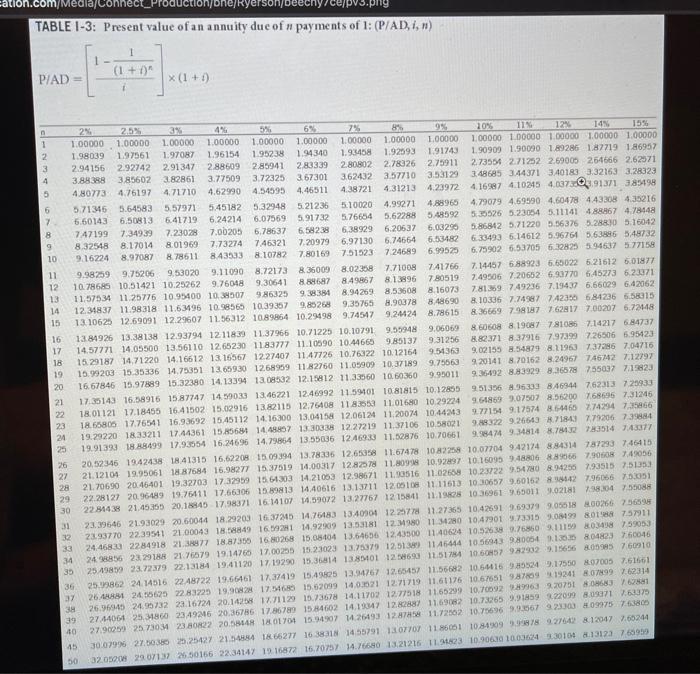

TR13-4 Debt Present Value (LO 13-4) Prentice Ltd. was authorized to issue $2,000,000 of 10-year, 6% bonds payable on 1 August 20x2. The bonds are due on 31 July 2012. Interest payments dates were 31 July and 31 January. The bond was sold to yleld 8%. (PV of $1. PVA of $1, and PVAD $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the proceeds from issuance. (Round time value factor to 5 decimal places. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount.) Proceeds from issuance es 2. Calculate the proceeds from Issuance if the yield rate is 5% and the bond is issued on August 20X4, still with a maturity date of 31 July 2012. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) Proceeds from issuanco 3. Calculate the proceeds from issuance if the yield rate is 8%, and the bond is issued between interest dates, on 1 October 20X2, still with a maturity date of 31 July 2012. Exclude accrued interest. (Round time value factor to 5 decimal places. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount.) Proceeds from issuanco TABLE 1-1: Present value of 1: (P/F,i, ) P/E (1 + i)" 6% 1 2 4 5 5 7 8 9 10 11 12 13 14 15 16 12 IH 19 20 21 22 23 M 20 24 2.5% 3 45 52 7% 9 0.98039 0.97561 10 115 12 0.97087 0.96154 0.9523 0.94310 15% 0.93458 0.92593 0.91743 0.90909 0.000 0.89286 0.96117 0.95181 0.94260 0.87719 0.90703 0.86957 0.92456 0.89000 0.8744 0.85734 0.84168 082645 0.81162 0.79719 0.76947 0.94232 0.92860 0.91514 0.88900 0.86381 0.75614 0.83962 0.81630 0.79393 0.77218 0.75131 0.73119 071178 055752 0.92085 0.90595 0.67497 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70443 0.90573 0.68301 0.65873 0.63552 0.59208 0.57175 0.88385 0.86261 082193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59315 0.56743 0.51937, 049718 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.66634 0.53017 0.59627 0.87056 056147 0.53464 050663 0.84122 0.81309 0.45659 0.43733 0.75992 0.71068 0.66505 0.62275 0.89 0.54703 051316 0.48156 045235 0.33964 0.8549 0.37594 082075 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 046651 0.43393 0.4058 035056 032690 083676 0.80073 0.76642 0.70259 064461 0.59190 0.94393 0,50025 0.46043 042610 0.39092 0 36001 0.82035 0.30751 0.78120 0.74409 067556 0.61391 0,55839 0.50835 046319 0422441 038556 0.35218 0.32197 026974 0.24718 080426 0.76214 0.72242 064958 0.58468 0.52679 047509 042498 0,38753 0.35049 0.31728 0.28180236000214 0.7819 0.74356 0.70138 062460 0:55684 0.49697 0.44401 0,39711 0,35553 0.51863 0.2854 0.26668 0.20756 18691 0.77303 0.72542 068095 0.60057 0.53032 0464 041496 0,36770 0.32618 028966 0.25751 022917 018207 0:16253 0.75788 0.70773 0.66112 0,57744 050507 0.44230 07820M016 0.29925 026333 0.23199 0.20062 DIY 0.14133 0.74301 0.69047 0.64186 0.555260481020.41727 0.3625 0.31624027654 02939 0.2020001827001401001229 0.72815 0.67362 062317 0,53391 0.49811 0.45 0.33873 0.29189 0.25187 021763 0.18829 0163120122) 010686 0.71416 0.65720 060500 0.5133 0.4630 037136 0.31657 0.27027 0.23107 0.1974 0.16963 0.14564 0107800.09293 0.70016 0.64117 0.58739 0.49353 0.41552 0.25034 0.296 0.25025 0.21199 0.17986 0.152 0.13004 00 OLONI 0.6863 0.62555 0.57029 04746A 0.39573 0.33051 0.27651 0.23171 0.1949 016351 0.13768 0.11611 0.082.95007027 0.67297 0.61027 0.59364 0456 0.37689 0.31180025412 0.21455 0.1783 0.14861 0.12403 010367 07275 0.05110 0.65978 0.5959053755 04 0.35M 0.29416 0.2151 0,19866 0.16370013513 0.11174 0.0956 2013 005313 0644 0.5806 0.02189 042190 OM 0.27751 0.22571 0.10.15018 0.1925 0.10067 0.0254 6.0699 0.04620 0.63416 0.56670 0.5066 040573 0.12557 0.251800-21095 0.17092 0.13778 01116 0.00069 0.07379 004911 00012 0.62172 0,552 049193 0.39012 0,31007 0.2 0.19715 0.15770 0.1 2010 010153 0.08170 006 0.0430 0.609530.54999 0.47761 037512 0.295 0.23 00 0.18425 0.14602 0.11597 0.09230 0.07 0.052 003 000 0.69758 0.52623 0.46369 036062 2012 0.2191 017220 0.13520 0.10639 OORS 0.06631 0.0125200331500242 0.6 0.51340 045019 0.3462 026785 0.20787 0.16093 0.12519 0.09761 0.02 0.05974 0.0408900208002297 0.67437 0.500 0.4370 0.19563 0.15040 01149100955 0.33318 0.26509 30199 00 0.02 0.04187 002551 0.56311 0.466 0.4235 032066 0 24295 0.18456 0.14056 0.10733 0.08215 0060 0.014 0.03758 002237 001) ILOS/31 0.55207 0.47614041199 O BON2 0.25 0.17411 0.13127 0,07007537 0.01 0.0333800196001510 0.020 0.01722 00131 0.54125 046511 0.39999 0.16425 0.12277 0.09202 0.069150.05210 0.03936 0.29646 022035 02038/ 0.28506 0,530630.45377 0 0.15496 0.11474 0.0520 0.04736 0261 10624 01510001142 0.5.2023 0.4427003770 0.27409 00039 0.14619 19981 0.10723 0.07 0.020 004306 0.00194 0.02576001329 600M 0.05339 0.13791 0.36604 026355 051003 0.43191 00116 0.10022 0.19036 0.75 40.008 0.02121 COM 0.1N129 13011 0.096 0.00763 0.04899 0.00003 042137 030538 025342 0.01019000751 0.0292 0.01894 00444 GO 35 0.00262 0.010 0.0081 000550 0.17266 0.12274 0.06754 049022 041109 0.34503 0.24367 D. B005 0.00106 0.01510 0.05790 0.007 0.04123001 0.16 0.1159 0.398 02430 0.41 040101 0.01893 0.01 0004 0.006 0.037 002575 0.47119 039128032523022529 0.156610,10924 0.076460,05569 0.00606 0.01 0.0104 DOMO 0.02430 0004 0.46195 08114 07146 0.01971 031575 021662 014915010306 DOS 0.005 000373 102303 0.0153 0.01075 04529 0.375 0.30656 0.20820 0 14205 0.09722 0.06678 0.01603 0.00186 0111 0.07255 0.01761 0.0153 0.0206 CO1N72 0.0093 0.00610 041070039917 0264.44017120 2015 0000 0.02 GOS 000542 LMS 200.05.290.000 0.37153 0.2281 0.14071 29 20 30 31 33 37 9 39 45 50 TABLE 1-2: Present value of an ordinary annuity of payments of 1: (P/A...) PIA= (1+1) 1 OVEO 1 2 4 9. 7 9 10 11 12 14 15 16 17 19 20 21 2.5% 54 7 99 0.98039 0.97561 097087 0.96154 095238 0.93458 09033091743090909 90090 089356 08779 080957 1.94156 1.92142 1.91347 1 R500 185941 1.8333 10B02 1.78326 1.79911173554 171252 1.6906 154666 1.62571 28 285602 2.80861 2.77500 272325 2.67301 2.6232 257710 253129 268 246.212.4015022016) 228323 3.R0773 3.76197 371710 36290 3.46511 3.38721 3.31213 3.239723.16987310265 30073520101 25498 4.71346 4.64583 4.57971 445180 43250 4.2123410020399271 396 3.79079 0260078 2216 5.60143 5.5081341719 5.24214 5.075694.91732 4.76654 4.62 4.49532420525 4 23054 411141 67 378 647199 6.34909 623028 6.000 5.78637 3.98238 5. 20637 5.03290468427122045637630 416042 7.32548 7.17014 7.0196 6.72074 646221 6 20979 5.97130 5.664 5532 5.3433514612 496764 46586 NZ 8.16224 7.97087 7.78611 7.43030 7.10782 680169 6.51523 6.2689 5.99525575900553705537805494637 47715 98250 875206 53020 8.11090 7.72173 7009 202358 671 OOR 641766614457 588923 56602921617 101827 9.78680 9.51421 9.25262 8.76048 830641 728587 7A67 711816 680519649505 6.206525.93770 5.45273523371 1057534 10 25776 3.95400 938507 886325 7.94262 7.53508 7.160736.8136964923661275560542062 11.34837 1098318 10.69896996065 39.7 268 835755 7.30318 1486907103356.787 542360584236558315 1210625 1.69091 11,29607 1056312989864 92 8.74547 3244247786156669 69818) 662817600207 372418 1284906 1238131193794 1111839 10.37966 271225 9.10791 588.660760608 71907 681086514217 5.84737 1357771 13.06500 1256110 1165230 10.83777 10.100909.44665 885137 8.31256 760371 7.57916 697526505 595423 1429187 1371220 13.166121216567 11 27407 10.47726976322 912164 8. 54363802158 7548797.11363637256604716 14.99203 14.3336 13.75351 1269930 11.689 10.82760 10.079 9.371898753 & 20141 770162 724976414212737 15.67816 14. 578814.32.380 1813394 12.0832 11.15812 10.33560 960350890011 849783929 736578650037 614803 16.35343 1598916 14.87747 1359033 12 46221 11 46992 T059401 581815 9.12850 8513567.96333 746965623132503 17.01121 16 1840 15.41500 14.02916 12.82115 11.76408 10.83563 10.01680 9.29224868628075075620065869346 17.65805 1676541 15.93690 14.45112 12 16300 1204158 11,0612 10.20074 9410856 8.1757 7.6446566.3866 18 29220 12.33211 16 44361 1485684 13.4857 1230318 11.27219 10.371059.002 3222664371 672056 1891393 124 16.90054 15 24696 13.79864 12 550,36 1146933 10.60876 9.70661 864 314 72432 6235166337 1952316 18.42458 1741315 1562208 14.093 12.78036 11.6358 10.6747898223807704 821147013146829345415 2012104 1895061 17876841568277 14.37519 13.00017 11.20578 10 809 9.3089) 3.16090 80 16 60608 47006 20.70690 19.46401 32703 16.3299 14.643031321053 11.871 10.90516 10.025589 23722 85780 7.54255650515 55153 2128127 19.948 76411 1666,306 14.89813 13.40616 12.13711 11.10 10.11613 9.30607 8601742 506 6501 2188 20:45.356 19 185 160371 15.14107 10272 12,27767 11.15841 10.12 2.36951260118 2239646 20 93029 19.50064 17.29203 15.37245 13.76483 1240904 11.25778 10.2736594291 8683798005187.00236568 22.93770 21.39541 20.00043 17.5854915281 13.92909 1203181 11 10.3280947901873315 E70145657911 244603 21 20 1787.35 15.026 14.08404 1264606 11 43900 10.40624 252675850 11150703303 2898866 22.29188 20.76679 1814755 16.00250 14.230231275379 115139 104664425610054 135520430046 2499 22.1237 21.13181841120 16 1920 14 3014 1285001 11.5459310360857 822 8256567.09.09 21.99862 22 34516: 214872 1866461 1637419 14425 12477 11.6457 10.56082261416 8175007005 75014 254894 235425 21 830219ZR 16516614.62093 1303521 11.71712 10.6117636760 1961 29.965 2295733 72 1672 19.1425 16,71129 14.73571 1311703 11.77518 10650 8996382075100 25.44064 24318602243246 19.36786 168671 14462 813347 28 10.60827325 322099 01635 26 902532473032210822 19.58418 17.01704 14.84907 13.253 11 10.72557 30578230037,0975663805 27 358 25-10228 23.13477 19.79217 12.19907 15.04530 1033171 11,2461 10.75735 7705 105 210504664178 2949016268332225187 20.72004 17.77407 1.4 1360062 12.10110 10 10 10 1007 27252712226550 3142361 283631 2976 214218 123761861380079 1223341 10616145104153 82130601 30 8353 cation.com/media/ TABLE 1-3: Present value of an annuity due of payments of 1: (P/AD, i, m) |- (1 - - PAD = x(1+1) 2 - 4 1 10 11 THE 1.00000 110000 1. Thion 1.00000 100000 100000 1. MOD00 100000 10000 100bao Tooo00 100000 1,00000 1.00pp0 199039 1061 19708) 1.95 | Ebe 196 14 19934 1.9.24 1991 2017-11 19090 1.9090 10286 1.4T/19 196947 294 156 29274 21:34 24Hr) 28911 2010 2 ADHD? 226 2. J Pro 11 2. Alber 2 ) 2006 Delph 26341 | 3807 316 12) 31/03 17225 do 01 3624.12 is TT10 3. 1 2 1.4860) 114.37] 14018] 1.216) 1.28.12.1 AGP3 Th111 471710 620 4.1511 , 14 21 4.31213 4.23972 416287 10245 4.007.4913/1 382498 71 -45 5.64593 95/9/1 5.46 14: 2016 Air 100CG 4.92 71 FS 2009 469990 40 0 14.... 4,1216 b. 6014 5.5M 1. ,AL T19 62421 6.01 1951 16FB. 51622 1976 534 3.11241 4BA6?m78148 197199 349 23020 7.00 21 6 hai 6 MB 6. Here 6. Oh JY 5.00 57.H2 97122) 5 6 124 10 ] Paul 2 8.12.4M 8.114 901969 17.1274 1.46.PT 2009 5.19730 AEF- 49) 5.146125.16ption sh THE B142 111 9.162 HTION: 8. TH611 14.11 A107H, HD 1 69 7612 199 6 11 6, 201705242) 2014 FELIY 5 PTT BLE 11 10.159 9.75216 953020 9.110908721P] 8.00 4.02.JPG 1. Plub G476 14568492,6,6902 6262 60]? TE 10 TH61.85 10 201421 10.2262 97604 10 ) a lin, 915 1.96 TOP 19 1916 170652 0.70 16:32L/1 11 07:44 11.76 10.99 00 10 (17) 9 16.25 1,4- 9 3 B16073 19749236 7 19477 6669 62062 14 1234437 11.90 318 11.6.45 16 2368 103930) 1. 9.3% 765 A.90 / 460 10.5 17 - Ab ER1. 15 1.11063 12 6909] 12.2507 11.6.12 108985 10.2498 974 M 92-4-24 B. 46 16 8 9 10 18:021700-07 02-15 its 1.3 4495 13.38 134 12.0.47 12 11 0 11.79% 10.122 10.10791 99-948 9413 A PAUTH 8 1967 78 15 14:21 / 681/27 17 14.5771 14.025600 13.56110 12.6%B2-30 1183777 III OB10 10 446 985133 91 BR71-879) 2017.19 6066952.1 13 20187 1471220 14.1612 13 16567 1227407 11.4TY26 10.7672 10.12]be h. 199 14079 41196 11:19670476 1992 16 35 36 ] 2351 1.1 6559.0 12 6HP DB9 | A2700 11.09% 1. JP189 15.1 91115:249645 11: 16.67 46 14.979 15.12380 10 13.19 13 HB32 1.1812 11.1.00 10 600 9 100L 9492 9192 14 706097 192.1 17.149 16.2089165 16.47747 14.00235 11.1621 12.46992 11.99901 1081816 10.17865 901.JPG 16 11 -46941 62.11a/TW.TT 1801121 17.18455 16.4102 16 (2016 13 11 12. TPM 98 11 3.08] 1101 680 10 2922 9-489 10707 8.46:100 16894 7.12345 21 18 GB81776_41 16.9692 15.4.112 14.16300 15.04158 12.06124 11 200 10.43 11/1 91 TFT AM 61 11 1-16 1120 18 11211 17.1151 IPS HP 68 Tel.N? 1 JOURN 12 19 11 ) 10 Mn1 122f9474 15.1.17.70 7.19 1981 1991391 18 HD499 17.0.054 15.2465 14 TAII 1.55LF 12.169.3 11. BCB/10706] 19434974H A TAIL L15L 14.1.17 20146 194243H AH-41.16 16,622 31 194 1.1.74 L6 12653 11.6/40 1023 10 orTM 94274 1 237746-14 21 121 0 1992 (6) 1H BJT08 10.92T IN TS19 10.00 17 12 11099 10. IT16090 11-16 2016 21 690 20 415401 19.12/03 1712290 18 11.11) || | CO. 1.18 ) 11. DESL 102 - 10:37:24 ) 2015-11-1 ?? 28127 20 TF 149 19. TF-411 17.stal 16 10 R1911 14.4116lb 1.1.JPTT La OIL 111161 10 1157 9.60 16: 54421166 191 28 21.49% 20.1 6419 17.11.171 les TM10 14.DT01 PBT 12 12-11 11.11n: 10 -16) 2011 102 19 | TEAM 21. Pro46 21.03021 20 6004 18 2120 16.47 410 11. tl43 19.April 12 H 1.75 10.49] 1691 90-518 0.141 2193770 2.19241 10799 14:4449 16 1341 1.921 19 11. B.ZHI 1.190 11 14:30 104 15-15 10-199 5071 79911 4 11 22 8491M 11/1TB HBP 16 HD 1.6 ID.COM180 |. TH): 1.4.10 || 40629 10.5 19 ) 201011 -3 05114 24 21 2018L 21.79 1914/16 17 0029) 16 21P] 11.7.79 12 138) IL AF-44 10 16-04 HD 1 ) 201APTh0016 29 198 / 2.1.2.179 2.1.11 AM 194 11 10 IT 1920 15.36 14 11.AP-401 12 M621 11.4L 1 11 DTH: 99.02 1. This 10476910 21 19 24 14 16 24872 19 itle] 11 19 11.49MB 11.47 13 2012 11.66GM: 10 -- 2014 1.174 700 Flor] | 21, LAMBI Bray PH1729 19 11/02 || TelHi 19 2009 10.21 12. 19 1.66 10 60519-9 11-24) 2009-14 6 PF-11-21 2 23.1 PM 0.1MPAN | 11:30 11 1.7 11.11 (10) 12 12 11.5D-799 II, Tay) 199999.11 4) 27.A.40 % 18 23.19246 20 3678 17.HT PRO 15 AMG02 10 1147 12 WEBHP 1169 11.ht 2014-9 1209 BUTTE-11 | | 2719T19 21 T100 21 HTTP220*144 1A CITI 16 140Y TH Crea191 12.4 AM DE ILTE: 11. TPM 16:12.10 410PTS 6.39 |||| - 1100% 27.90 2012/21 1484 18 27 ]U 10 14-5-19) JuOPPO 11 ] 10 41 27 18 11-12 8.1.1476021 | 11 12 peVUE 107 | 37 : 201166 22.1.4T ? 11 1.8T 1h 30 14. THE HD 1.1212TE TI94M73 | 9000 11 1.1024 1010-1 11:11P] 14.1979 ww TR13-4 Debt Present Value (LO 13-4) Prentice Ltd. was authorized to issue $2,000,000 of 10-year, 6% bonds payable on 1 August 20x2. The bonds are due on 31 July 2012. Interest payments dates were 31 July and 31 January. The bond was sold to yield 8%. (PV of $1. PVA of $1. and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the proceeds from issuance. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) Proceeds from issuance 2. Calculate the proceeds from issuance if the yield rate is 5% and the bond is issued on 1 August 20X4, still with a maturity date of 31 July 2012. (Round time value factor to 5 decimal places. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount.) Proceeds from issuance 3. Calculate the proceeds from Issuance if the yield rate is 8%, and the bond is issued between interest dates, on 1 October 20X2, stin with a maturity date of 31 July 2012. Exclude accrued interest. (Round time value factor to 5 decimal places. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount.) Proceeds from issuance Prev 1 of 3 !!! Score answer >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts