Question: answer asap QUESTION 5 (a) (i) Name four methods of evaluating projects and their respective decision criteria/criterion. (4 marks) (ii) What is/are the purpose(s) of

answer asap

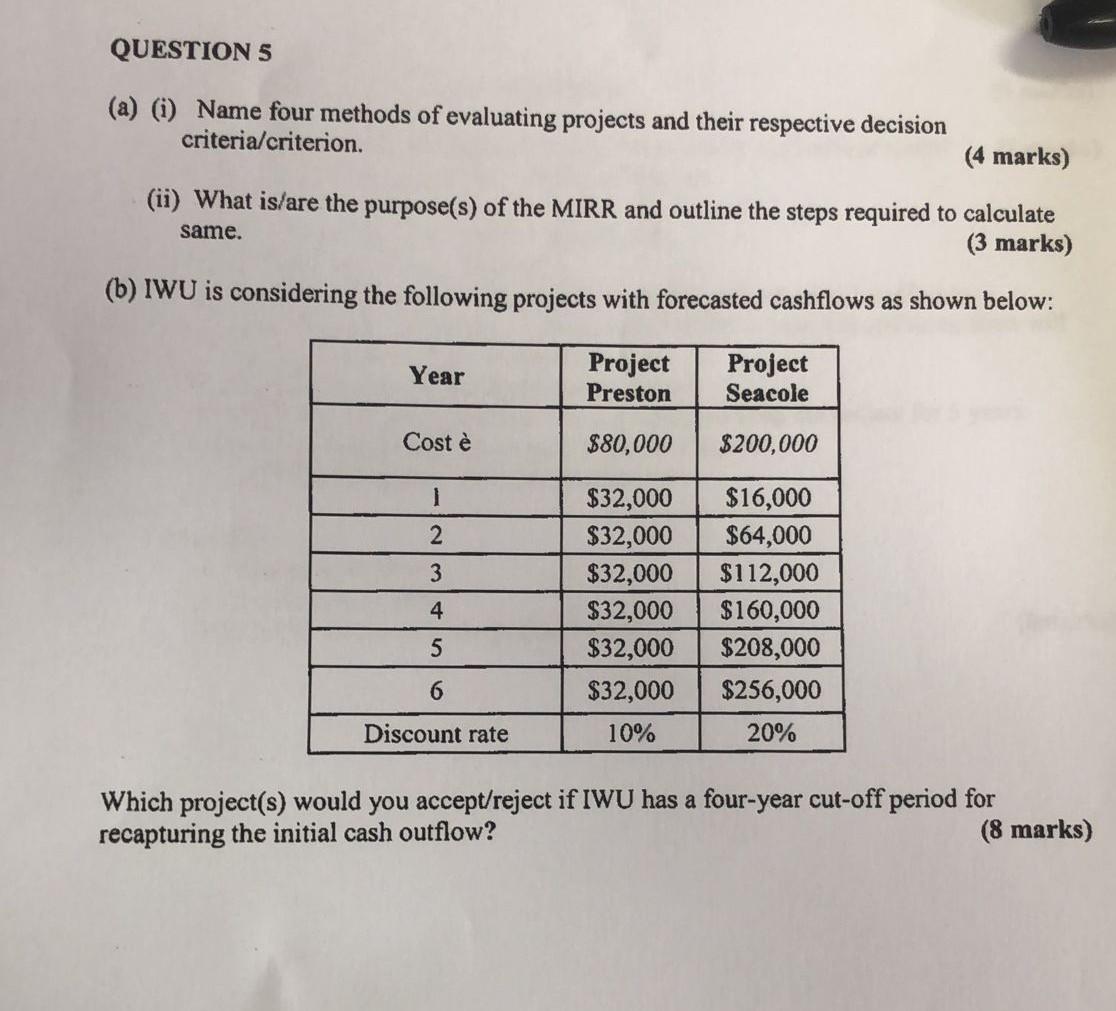

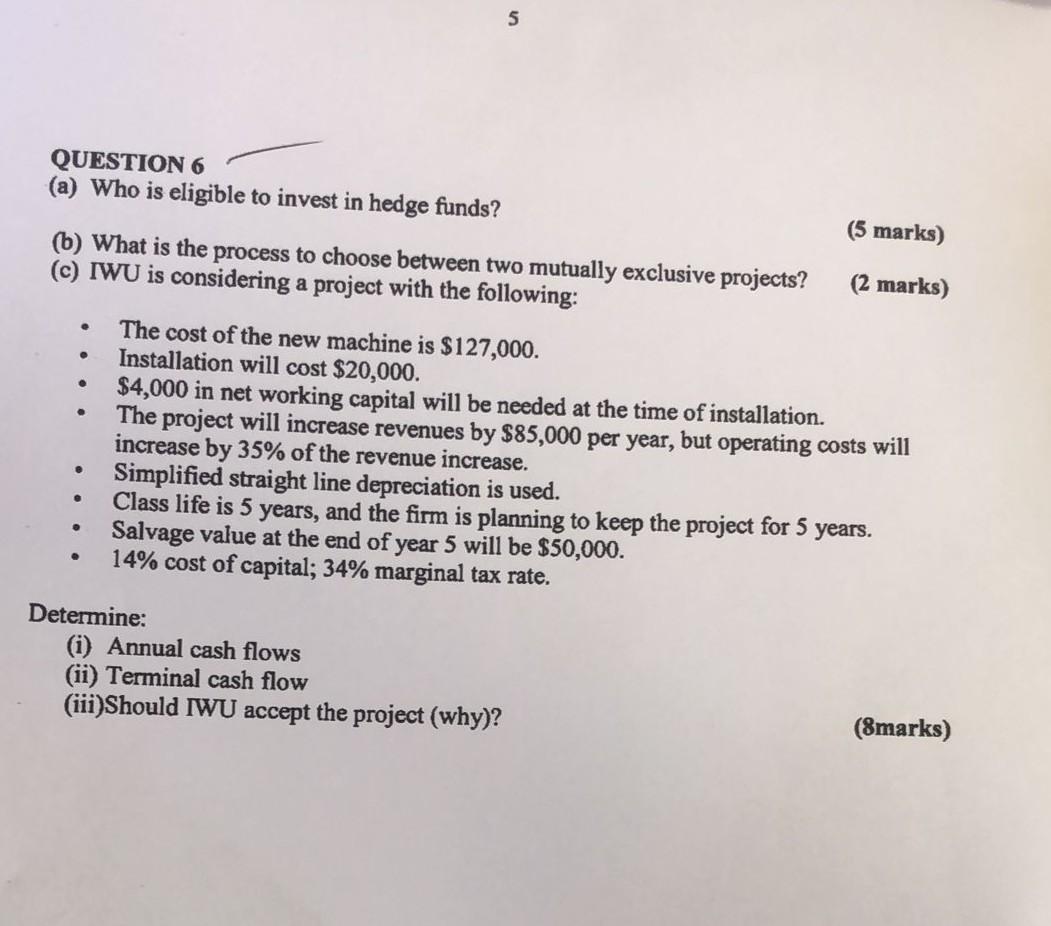

QUESTION 5 (a) (i) Name four methods of evaluating projects and their respective decision criteria/criterion. (4 marks) (ii) What is/are the purpose(s) of the MIRR and outline the steps required to calculate same. (3 marks) (b) IWU is considering the following projects with forecasted cashflows as shown below: Year Project Preston Project Seacole Cost $80,000 $200,000 1 2 3 4 $32,000 $32,000 $32,000 $32,000 $32,000 $32,000 10% $16,000 $64,000 $112,000 $160,000 $208,000 $256,000 20% 5 6 Discount rate Which project(s) would you accept/reject if IWU has a four-year cut-off period for recapturing the initial cash outflow? (8 marks) 5 QUESTION 6 (a) Who is eligible to invest in hedge funds? (5 marks) (b) What is the process to choose between two mutually exclusive projects? c) IWU is considering a project with the following: (2 marks) . The cost of the new machine is $127,000. Installation will cost $20,000. $4,000 in net working capital will be needed at the time of installation. The project will increase revenues by $85,000 per year, but operating costs will increase by 35% of the revenue increase. Simplified straight line depreciation is used. Class life is 5 years, and the firm is planning to keep the project for 5 years. Salvage value at the end of year 5 will be $50,000. 14% cost of capital; 34% marginal tax rate. Determine: (i) Annual cash flows (ii) Terminal cash flow (iii)Should IWU accept the project (why)? (8marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts