Question: answer asap Question 8 (2 points) Suppose Indigo Books and Music has a beta of 0.75. The yield on a 3-month T-bill is 4% and

answer asap

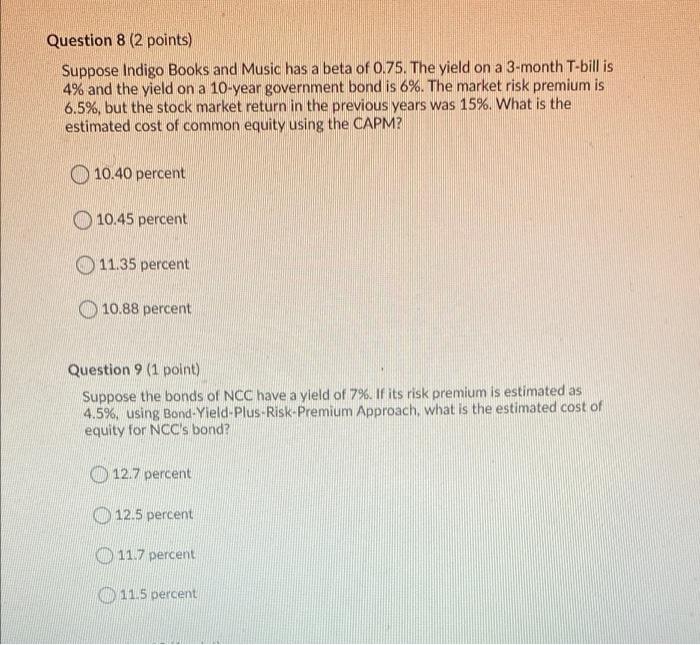

Question 8 (2 points) Suppose Indigo Books and Music has a beta of 0.75. The yield on a 3-month T-bill is 4% and the yield on a 10-year government bond is 6%. The market risk premium is 6.5%, but the stock market return in the previous years was 15%. What is the estimated cost of common equity using the CAPM? 10.40 percent 10.45 percent 11.35 percent 10.88 percent Question 9 (1 point) Suppose the bonds of NCC have a yield of 7%. If its risk premium is estimated as 4.5%) using Bond-Yield-Plus-Risk-Premium Approach, what is the estimated cost of equity for NCC's bond? 0 12.7 percent 12.5 percent 0 11.7 percent 11.5 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock