Question: answer ASAP You are given the following data concerning a stock: 1. The risk-free rate is 2.5 percent. 2. The required return on the market

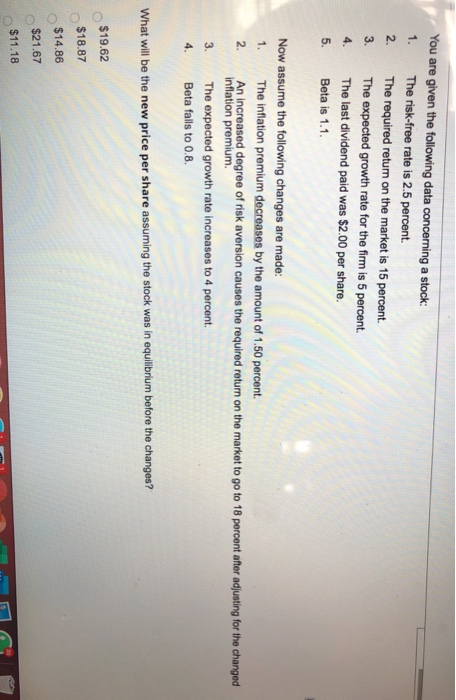

You are given the following data concerning a stock: 1. The risk-free rate is 2.5 percent. 2. The required return on the market is 15 percent. 3. The expected growth rate for the firm is 5 percent. The last dividend paid was $2.00 per share. 5. Beta is 1.1. Now assume the following changes are made: 1. The inflation premium decreases by the amount of 1.50 percent. 2. An increased degree of risk aversion causes the required return on the market to go to 18 percent after adjusting for the changed inflation premium. The expected growth rate increases to 4 percent 4. Beta falls to 0.8. What will be the new price per share assuming the stock was in equilibrium before the changes? $19.62 $18.87 $14.86 $21.67 $11.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts