Question: Answer assessment question Question 1 Not yet Short Answer Task 1.3 answered Marked out of 1.00 Q1. In the table below, calculate the P&L changes

Answer assessment question

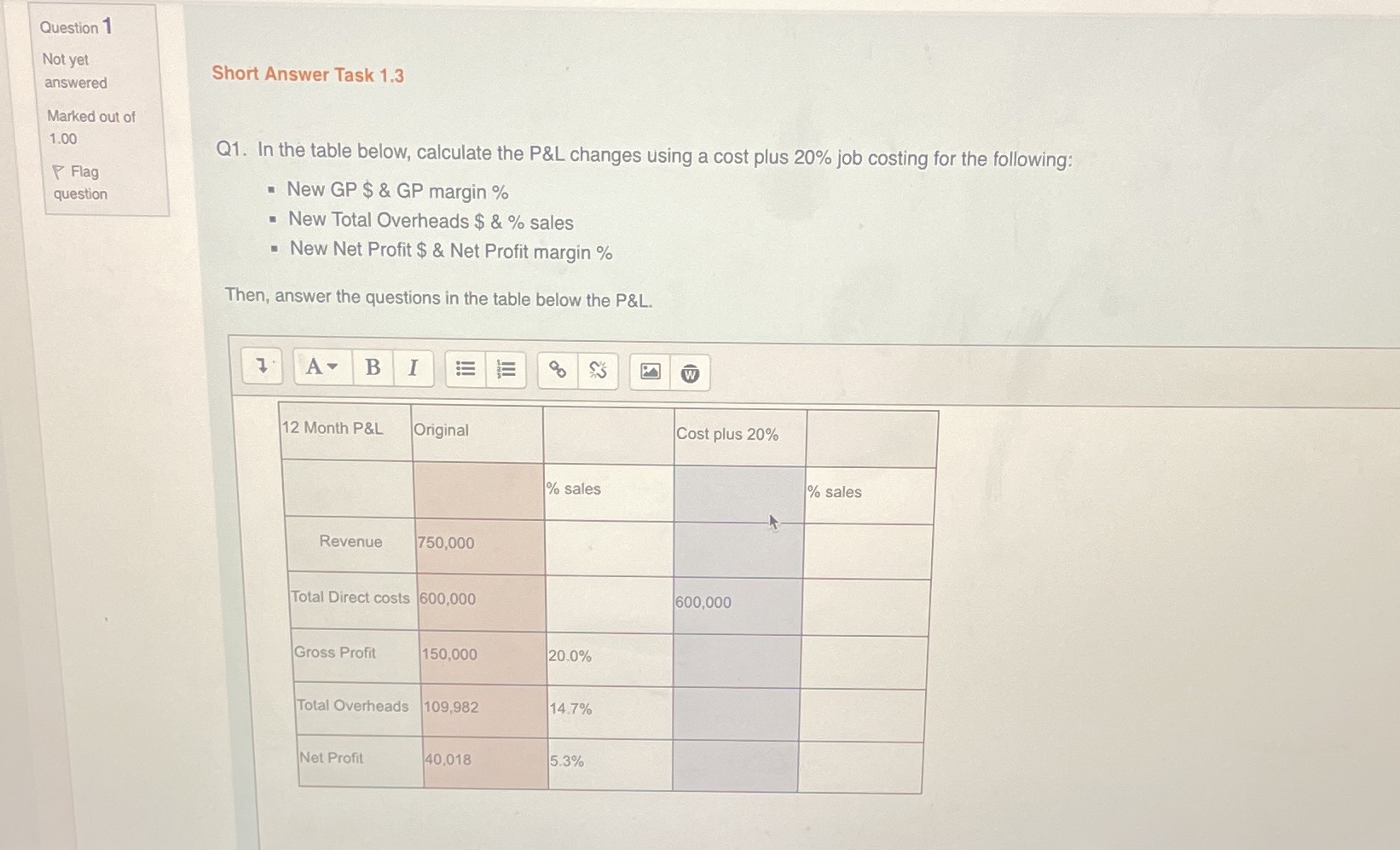

Question 1 Not yet Short Answer Task 1.3 answered Marked out of 1.00 Q1. In the table below, calculate the P&L changes using a cost plus 20% job costing for the following: Flag question New GP $ & GP margin % - New Total Overheads $ & % sales - New Net Profit $ & Net Profit margin % Then, answer the questions in the table below the P&L. 1 A B I E W 12 Month P&L Original Cost plus 20% % sales % sales Revenue 750,000 Total Direct costs 600,000 600,000 Gross Profit 150,000 20.0% Total Overheads 109,982 14.7% Net Profit 40,018 5.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts