Question: Answer b) and c) please QUESTION B2 A financial Analyst wants to evaluate the feasibility of his investment options. The following payoff table shows the

Answer b) and c) please

Answer b) and c) please

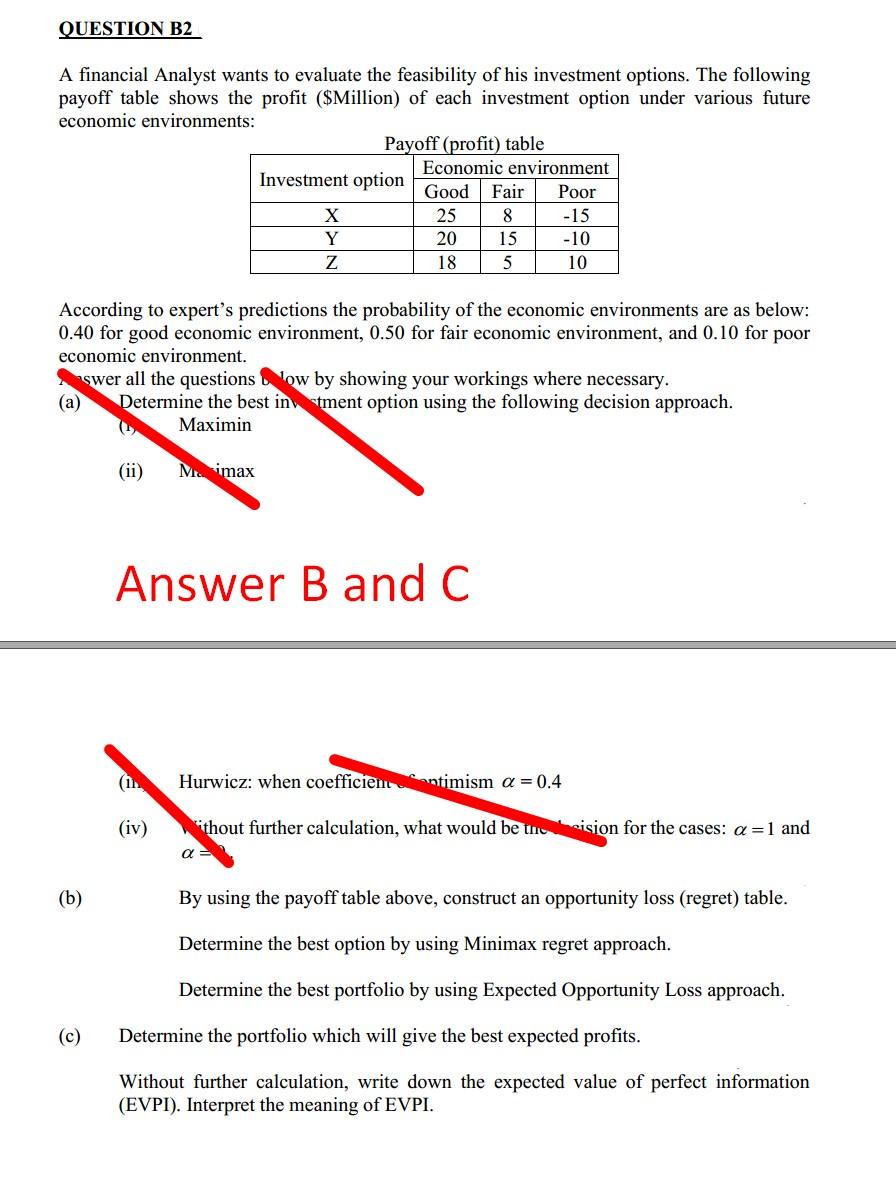

QUESTION B2 A financial Analyst wants to evaluate the feasibility of his investment options. The following payoff table shows the profit ($Million) of each investment option under various future economic environments: Payoff (profit) table Investment option Economic environment Good Fair Poor X 25 8 -15 Y 20 15 - 10 Z 18 5 10 According to expert's predictions the probability of the economic environments are as below: 0.40 for good economic environment, 0.50 for fair economic environment, and 0.10 for poor economic environment. swer all the questions low by showing your workings where necessary. (a) Determine the best intment option using the following decision approach. Maximin Me imax Answer Band C (in Hurwicz: when coefficient antimism a=0.4 (iv) thout further calculation, what would be und sision for the cases: a=1 and a (b) By using the payoff table above, construct an opportunity loss (regret) table. Determine the best option by using Minimax regret approach. Determine the best portfolio by using Expected Opportunity Loss approach. (c) Determine the portfolio which will give the best expected profits. Without further calculation, write down the expected value of perfect information (EVPI). Interpret the meaning of EVPI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts