Question: answer b and c would be appericated thank you. Student Name: NOTE: Ensure you submit ALL applicable forms. This OPEN BOOK assessment is worth 5%

answer b and c would be appericated thank you.

answer b and c would be appericated thank you.

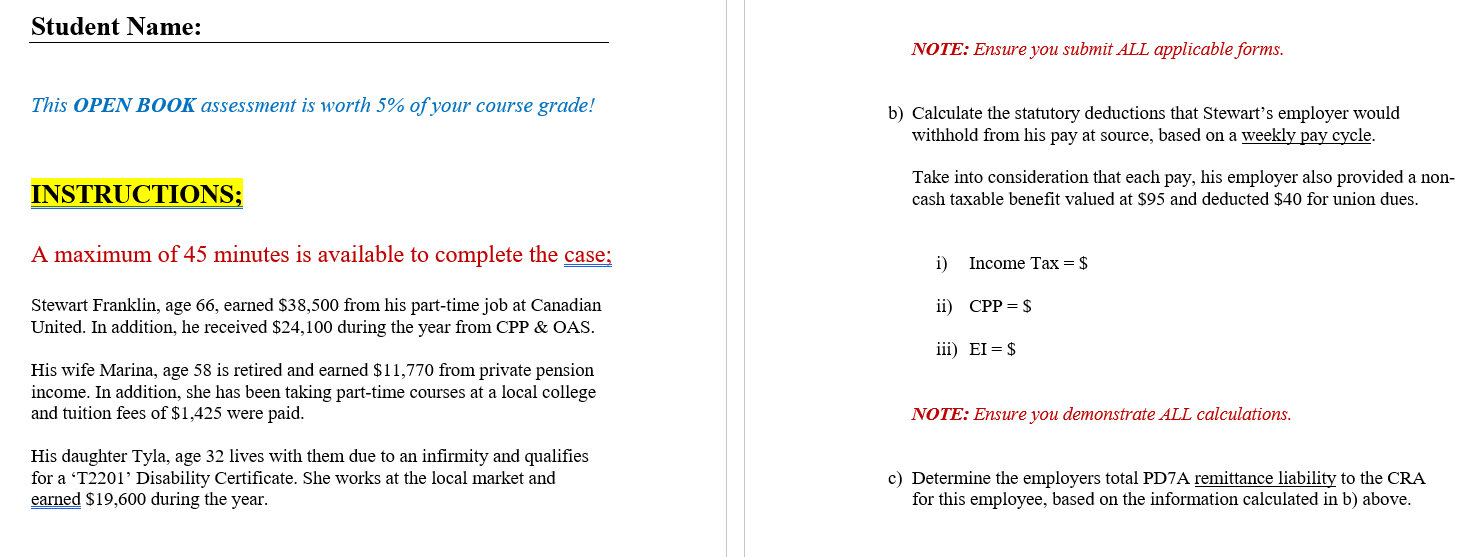

Student Name: NOTE: Ensure you submit ALL applicable forms. This OPEN BOOK assessment is worth 5% of your course grade! b) Calculate the statutory deductions that Stewart's employer would withhold from his pay at source, based on a weekly pay cycle. INSTRUCTIONS; Take into consideration that each pay, his employer also provided a non- cash taxable benefit valued at $95 and deducted $40 for union dues. A maximum of 45 minutes is available to complete the case; i) Income Tax = $ ii) CPP = $ Stewart Franklin, age 66, earned $38,500 from his part-time job at Canadian United. In addition, he received $24,100 during the year from CPP & OAS. iii) EI = $ His wife Marina, age 58 is retired and earned $11,770 from private pension income. In addition, she has been taking part-time courses at a local college and tuition fees of $1,425 were paid. NOTE: Ensure you demonstrate ALL calculations. His daughter Tyla, age 32 lives with them due to an infirmity and qualifies for a T2201 Disability Certificate. She works at the local market and earned $19,600 during the year. c) Determine the employers total PD7A remittance liability to the CRA for this employee, based on the information calculated in b) above. Student Name: NOTE: Ensure you submit ALL applicable forms. This OPEN BOOK assessment is worth 5% of your course grade! b) Calculate the statutory deductions that Stewart's employer would withhold from his pay at source, based on a weekly pay cycle. INSTRUCTIONS; Take into consideration that each pay, his employer also provided a non- cash taxable benefit valued at $95 and deducted $40 for union dues. A maximum of 45 minutes is available to complete the case; i) Income Tax = $ ii) CPP = $ Stewart Franklin, age 66, earned $38,500 from his part-time job at Canadian United. In addition, he received $24,100 during the year from CPP & OAS. iii) EI = $ His wife Marina, age 58 is retired and earned $11,770 from private pension income. In addition, she has been taking part-time courses at a local college and tuition fees of $1,425 were paid. NOTE: Ensure you demonstrate ALL calculations. His daughter Tyla, age 32 lives with them due to an infirmity and qualifies for a T2201 Disability Certificate. She works at the local market and earned $19,600 during the year. c) Determine the employers total PD7A remittance liability to the CRA for this employee, based on the information calculated in b) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts