Question: answer b for the thumb's up Coronado, Ltd. is a local coat retailer. The store's accountant prepared the following income statement for the month ended

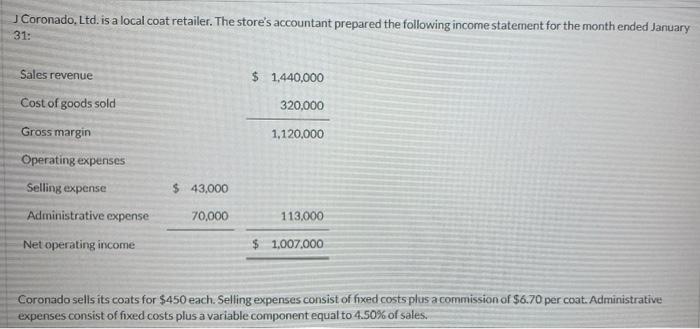

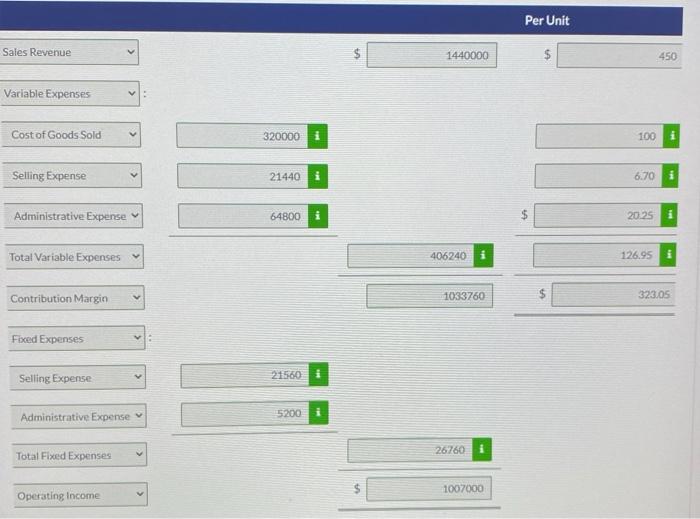

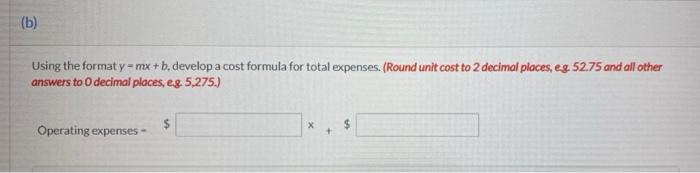

Coronado, Ltd. is a local coat retailer. The store's accountant prepared the following income statement for the month ended January 31: Sales revenue $ 1.440,000 320,000 1,120,000 Cost of goods sold Gross margin Operating expenses Selling expense Administrative expense Net operating income 43,000 70,000 113,000 $ 1.007.000 Coronado sells its coats for $450 each. Selling expenses consist of fixed costs plus a commission of $6.70 per coat. Administrative expenses consist of fixed costs plus a variable component equal to 4.50% of sales. Per Unit Sales Revenue $ 1440000 $ 450 Variable Expenses Cost of Goods Sold 320000 100 1 Selling Expense 21440 i 6.70 i Administrative Expense 64800 i 20.25 i Total Variable Expenses 406240 126.95 Contribution Margin 1033760 $ 323.05 Fixed Expenses Selling Expense v 21560 Administrative Expense 5200 26760 Total Fixed Expenses 1007000 Operating Income (b) Using the formaty = mx + b develop a cost formula for total expenses. (Round unit cost to 2 decimal places, eg 52.75 and all other answers to decimal places, eg. 5,275.) $ Operating expenses - X +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts