Question: answer b please Rate Consider a one-year interest rate swap with semiannual payments. (a) Determine the fixed rate on the swap and express it in

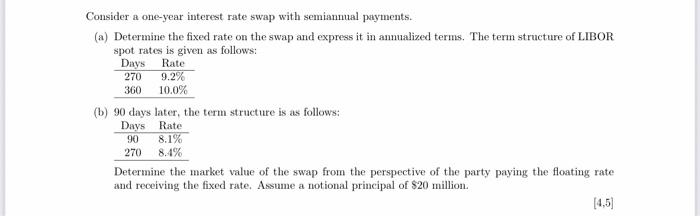

Rate Consider a one-year interest rate swap with semiannual payments. (a) Determine the fixed rate on the swap and express it in analized terms. The term structure of LIBOR spot rates is given as follows: Days 270 9.2% 360 10.0% (b) 90 days later, the term structure is as follows: Days Rate 8.1% 270 8.4% Determine the market value of the swap from the perspective of the party paying the floating rate and receiving the fixed rate. Assume a notional principal of $20 million. 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts