Question: Answer B Quiz Submis MindTap - Cengage Learning X L uwg courseden login - Bing X X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=58326424512456945640819 CENGAGE | MINDTAP Aplia Homework: Banking and

Answer

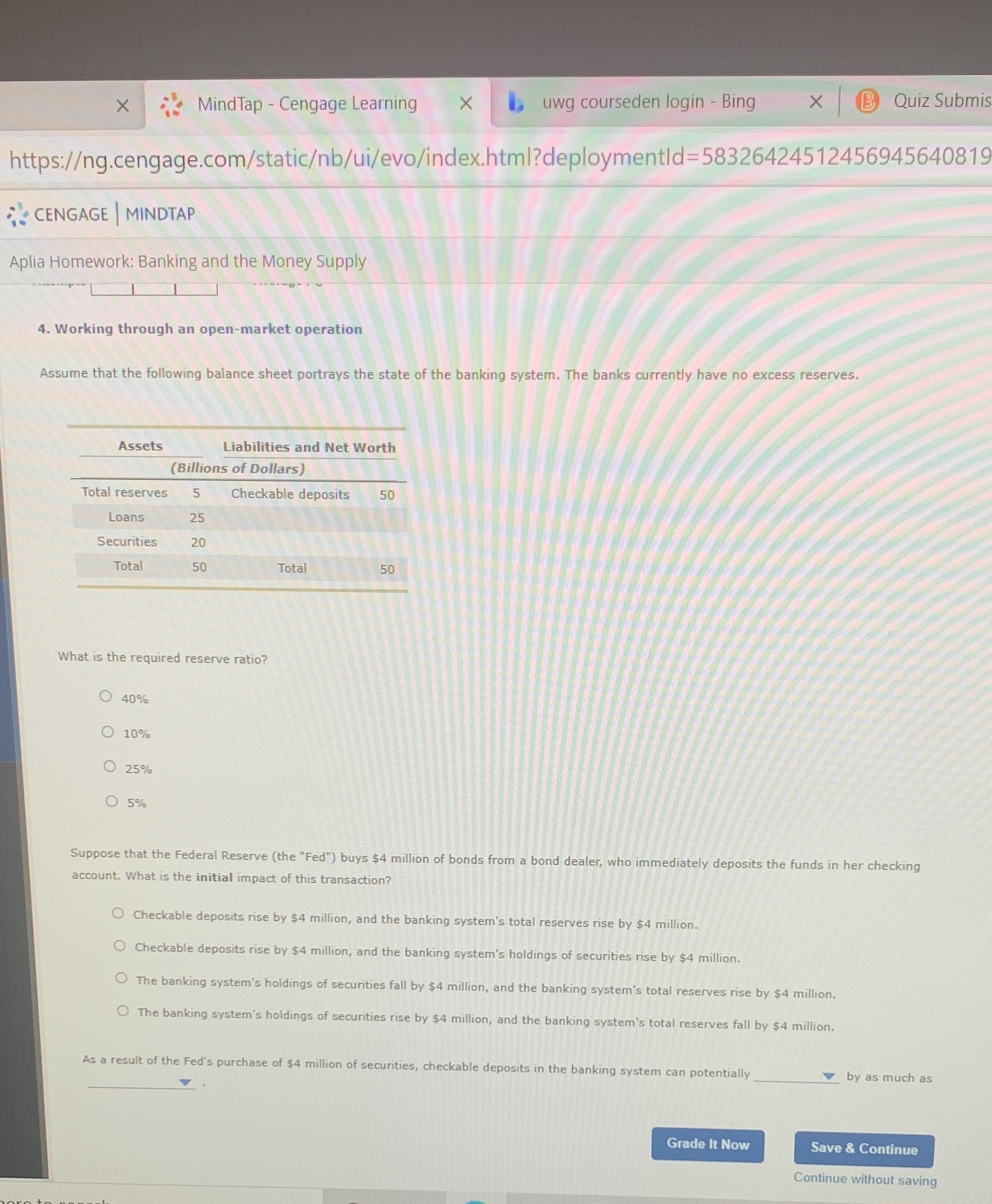

B Quiz Submis MindTap - Cengage Learning X L uwg courseden login - Bing X X https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=58326424512456945640819 CENGAGE | MINDTAP Aplia Homework: Banking and the Money Supply 4. Working through an open-market operation Assume that the following balance sheet portrays the state of the banking system. The banks currently have no excess reserves. Assets Liabilities and Net Worth (Billions of Dollars) Total reserves 5 Checkable deposits 50 Loans 25 Securities 20 Total 50 Total 50 What is the required reserve ratio? 40% 10% O 25% O 5% Suppose that the Federal Reserve (the "Fed") buys $4 million of bonds from a bond dealer, who immediately deposits the funds in her checking account. What is the initial impact of this transaction? Checkable deposits rise by $4 million, and the banking system's total reserves rise by $4 million. Checkable deposits rise by $4 million, and the banking system's holdings of securities rise by $4 million. The banking system's holdings of securities fall by $4 million, and the banking system's total reserves rise by $4 million. The banking system's holdings of securities rise by $4 million, and the banking system's total reserves fall by $4 million. As a result of the Fed's purchase of $4 million of securities, checkable deposits in the banking system can potentially by as much as Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts