Question: answer (b,c,d) Total 20 marks 1. The Bay Company last paid their dividend of $2.7 to the stockholders. For the first 4 years the dividend

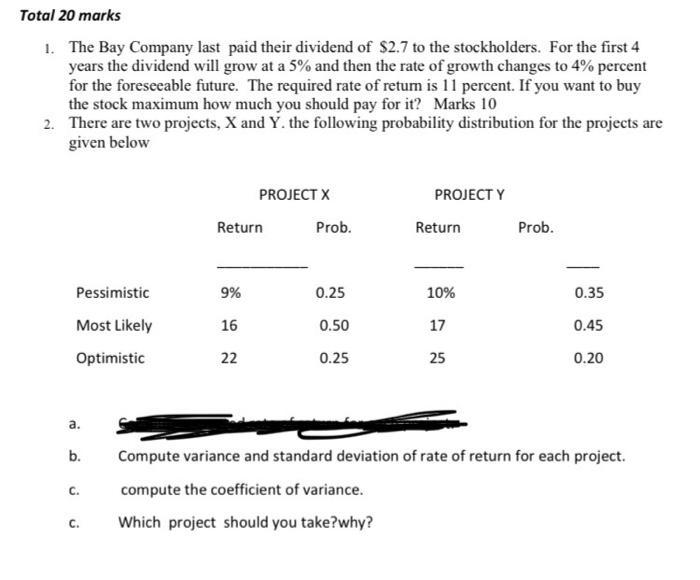

Total 20 marks 1. The Bay Company last paid their dividend of $2.7 to the stockholders. For the first 4 years the dividend will grow at a 5% and then the rate of growth changes to 4% percent for the foreseeable future. The required rate of retum is 11 percent. If you want to buy the stock maximum how much you should pay for it? Marks 10 2. There are two projects, X and Y the following probability distribution for the projects are given below PROJECT Y PROJECT X Return Prob. Return Prob. 9% 0.25 10% 0.35 Pessimistic Most Likely Optimistic 16 0.50 0.45 17 25 22 0.25 0.20 a. b. C. Compute variance and standard deviation of rate of return for each project. compute the coefficient of variance. Which project should you take?why? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts