Question: answer both correctly please Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment,

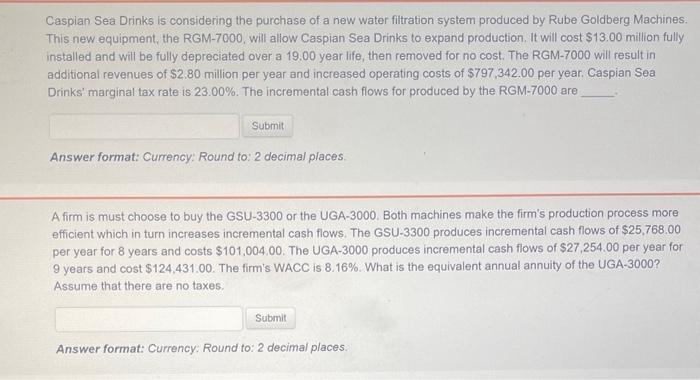

Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 19.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.80 million per year and increased operating costs of $797,342.00 per year. Caspian Sea Drinks' marginal tax rate is 23.00%. The incremental cash flows for produced by the RGM-7000 are Answer format: Currency: Round to: 2 decimal places. A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $25,768.00 per year for 8 years and costs $101,004,00. The UGA-3000 produces incremental cash flows of $27,254.00 per year for 9 years and cost $124,431.00. The firm's WACC is 8.16%. What is the equivalent annual annuity of the UGA-3000? Assume that there are no taxes. Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts