Question: answer both correctly please Things Get Messi Enterprises is issuing new bonds for a capital budgeting project. The bonds will have 15.00 year maturities with

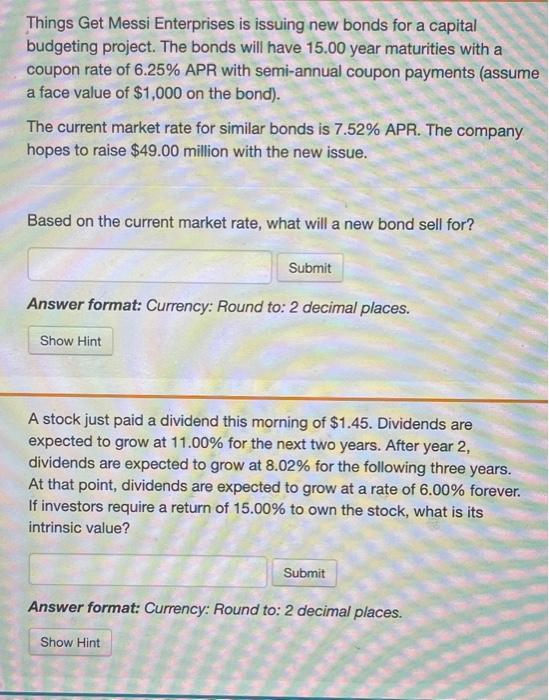

Things Get Messi Enterprises is issuing new bonds for a capital budgeting project. The bonds will have 15.00 year maturities with a coupon rate of 6.25% APR with semi-annual coupon payments (assume a face value of $1,000 on the bond). The current market rate for similar bonds is 7.52% APR. The company hopes to raise $49.00 million with the new issue. Based on the current market rate, what will a new bond sell for? Answer format: Currency: Round to: 2 decimal places. A stock just paid a dividend this morning of $1.45. Dividends are expected to grow at 11.00% for the next two years. After year 2 , dividends are expected to grow at 8.02% for the following three years. At that point, dividends are expected to grow at a rate of 6.00% forever. If investors require a return of 15.00% to own the stock, what is its intrinsic value? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts