Question: answer both economics for engineers please solve by hand 11-12 The company treasurer must determine the best A depreciation method for office furniture that costs

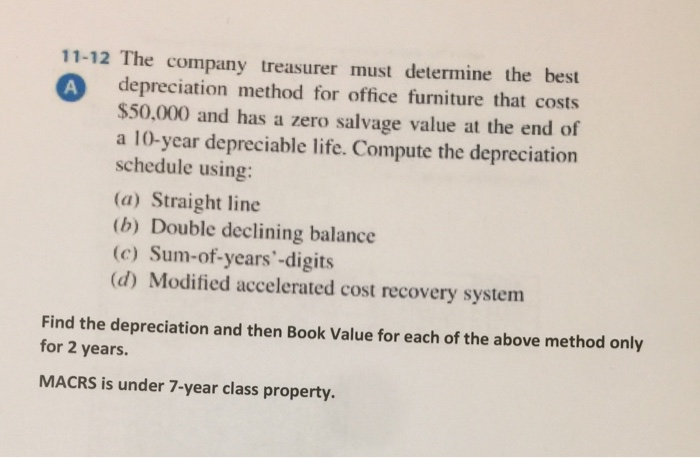

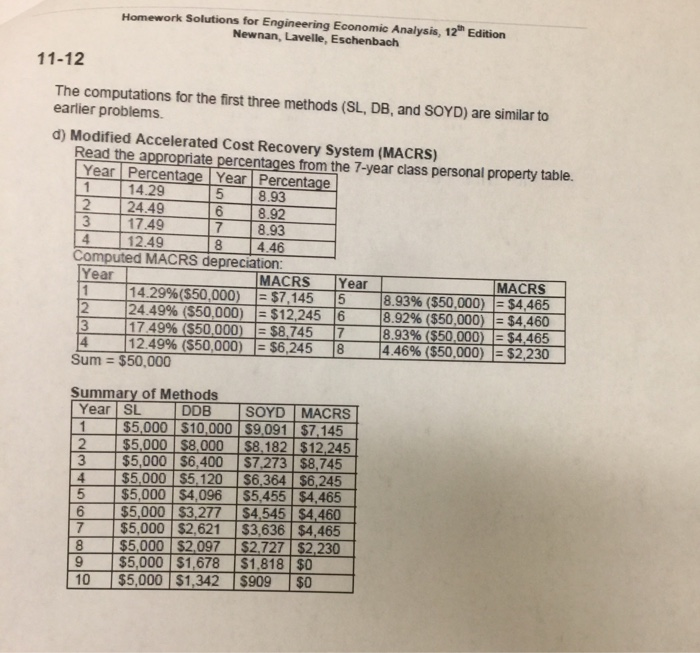

11-12 The company treasurer must determine the best A depreciation method for office furniture that costs $50,000 and has a zero salvage value at the end of a 10-year depreciable life. Compute the depreciation schedule using: (a) Straight line (b) Double declining balance (c) Sum-of-years'-digits (d) Modified accelerated cost recovery system Find the depreciation and then Book Value for each of the above method only for 2 years. MACRS is under 7-year class property. Homework Solutions for Engineering Economic Analysis, 12h Edition Newnan, Lavelle, Eschenbach 11-12 The computations for the first three methods (SL, DB, and SOYD) are similar to earlier problems. d) Modified Accelerated Cost Recovery System (MACRS) Read the appropriate percentages from the 7-year class personal property table. Year Percentage Year Percentage 114.29 2 3 17.49 5 8.93 6 8.92 7 8.93 8 446 Computed MACRS depreciation 24.49 12.49 MACRS Year 1 2 4 MACRS Year -$7,145 5 -S12.245.6 893% (s50 000) -s4465 8 9296 $50,000)- $4,460 8.93% (550 000) E $4465 14.29%($50.000) 24 49% s50.000) 1 12 4996 ($50,000) |: $6.245 18 Sum: $50,000 Summary of Methods Year SL 1 $5,000 $10,000 $9091 $7145 2 $5,000 S8,000 S8,182 $12.245 $5,000 $6,400 $7,273 $8,745 63646245 | $5,0005.120 5 $5,000 $4,096 $5,455 $4.465 6 $5,000 $3,277 $4545 $4.460 7$5.000 $2,621 $3,636 $4,465 8 $5,000 $2.097 $2.727-2.230 9 $5,000 $1,678 $1818 $0 10 $5,000 $1,342 5909 SO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts