Question: Answer BOTH items below: i) HST (5 marks) Your client (an individual) operates a service business as a sole proprietorship in Ontario. The HST rate

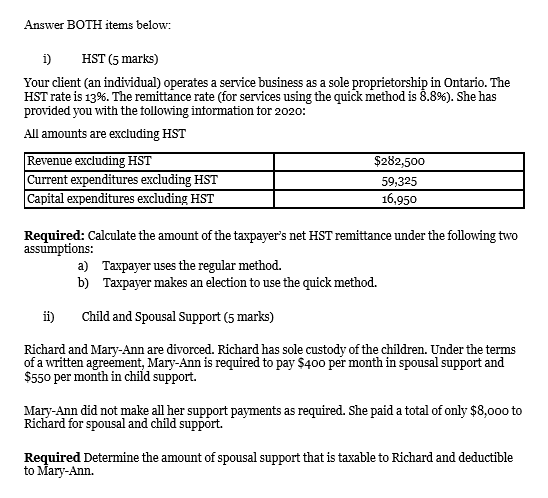

Answer BOTH items below: i) HST (5 marks) Your client (an individual) operates a service business as a sole proprietorship in Ontario. The HST rate is 13%. The remittance rate (for services using the quick method is 8.8%). She has provided you with the following information for 2020: All amounts are excluding HST Revenue excluding HST $282,500 Current expenditures excluding HST 59,325 Capital expenditures excluding HST 16,950 Required: Calculate the amount of the taxpayer's net HST remittance under the following two assumptions: a) Taxpayer uses the regular method. b) Taxpayer makes an election to use the quick method. ii) Child and Spousal Support (5 marks) Richard and Mary-Ann are divorced. Richard has sole custody of the children. Under the terms of a written agreement, Mary-Ann is required to pay $400 per month in spousal support and $550 per month in child support. Mary-Ann did not make all her support payments as required. She paid a total of only $8,ooo to Richard for spousal and child support Required Determine the amount of spousal support that is taxable to Richard and deductible to Mary-Ann

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts