Question: ANSWER BOTH! On December 1, McGonagall Inc. received a 90-day note for $30,000 from Flitwick Limited when McGonagall sold merchandise to Flitwick. The note bears

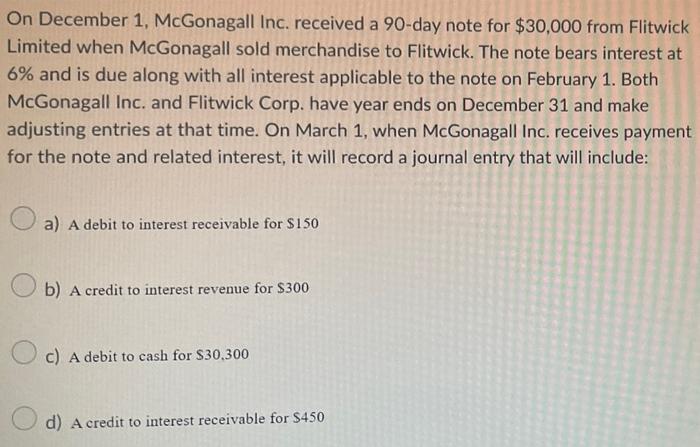

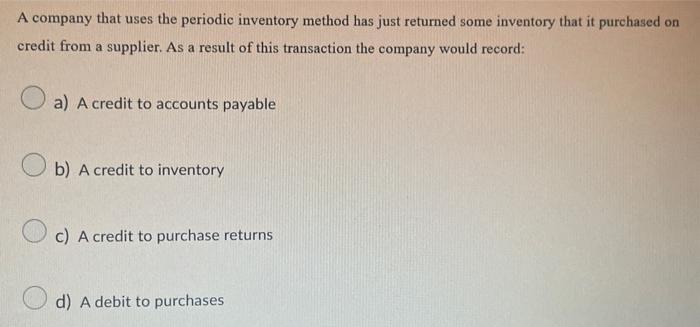

On December 1, McGonagall Inc. received a 90-day note for $30,000 from Flitwick Limited when McGonagall sold merchandise to Flitwick. The note bears interest at 6% and is due along with all interest applicable to the note on February 1. Both McGonagall Inc. and Flitwick Corp. have year ends on December 31 and make adjusting entries at that time. On March 1, when McGonagall Inc. receives payment for the note and related interest, it will record a journal entry that will include: a) A debit to interest receivable for $150 b) A credit to interest revenue for $300 c) A debit to cash for $30,300 d) A credit to interest receivable for $450 A company that uses the periodic inventory method has just returned some inventory that it purchased on credit from a supplier. As a result of this transaction the company would record: a a) A credit to accounts payable b) A credit to inventory c) A credit to purchase returns d) A debit to purchases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts