Question: Answer both please as no questions remain! Thumbs up! The CFO of MediSearch plo believes that investing into a project which will develop a new

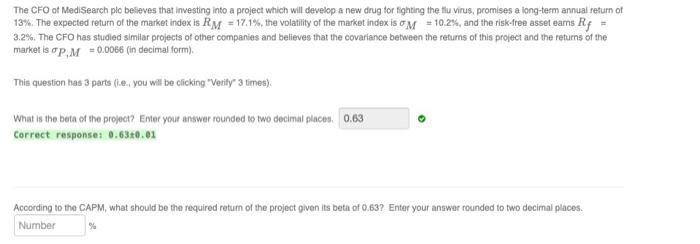

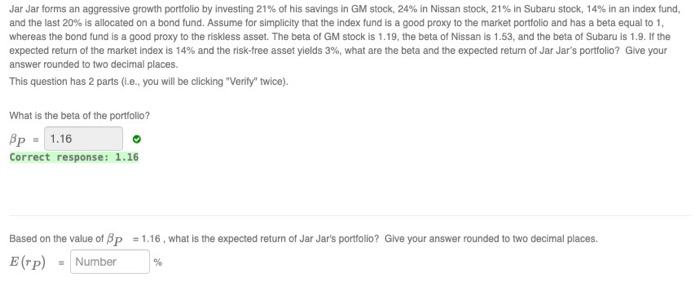

The CFO of MediSearch plo believes that investing into a project which will develop a new drug for fighting the flu virus, promises a long-term annual return of 13%. The expected return of the market index is RM = 17.1%, the volatility of the market index is o M = 10.2%, and the risk-free asset eams Rg = 3.2%. The CFO has studied similar projects of other companies and believes that the covariance between the returns of this project and the returns of the market is op, M +0.0066 (in decimal form). This question has 3 parts (... you will be clicking "Verily 3 times) What is the bota of the project? Enter your answer rounded to two decimal places. 0.63 Correct response: 0.630.01 According to the CAPM, what should be the required return of the project given its beta of 0.63? Enter your answer rounded to two decimal places. Number Jar Jar forms an aggressive growth portfolio by investing 21% of his savings in GM stock, 24% in Nissan stock, 21% in Subaru stock, 14% in an index fund, and the last 20% is allocated on a bond fund. Assume for simplicity that the index fund is a good proxy to the market portfolio and has a beta equal to 1, whereas the bond fund is a good proxy to the riskless asset. The beta of GM stock is 1.19, the beta of Nissan is 1.53, and the beta of Subaru is 1.9. If the expected return of the market Index is 14% and the risk-free asset yields 3%, what are the beta and the expected return of Jar Jar's portfolio? Give your answer rounded to two decimal places. This question has 2 parts (t... you will be clicking "Verily twice). What is the beta of the portfolio? Bp - 1.16 Correct response: 1.16 Based on the value of BP = 1.16, what is the expected return of Jar Jar's portfolio? Give your answer rounded to two decimal places. EGP) = Number %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts