Question: answer both please Cullumber Lumber, Inc, is considering purchasing a new wood saw that costs $40,000. The saw will generate revenues of $100,000 per year

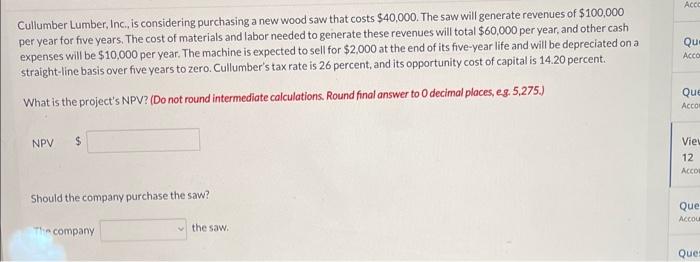

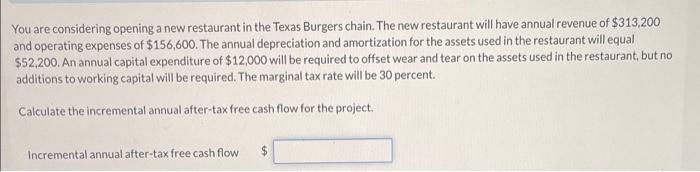

Cullumber Lumber, Inc, is considering purchasing a new wood saw that costs $40,000. The saw will generate revenues of $100,000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $2,000 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Cullumber's tax rate is 26 percent, and its opportunity cost of capital is 14.20 percent. What is the project's NPV? (Do not round intermediate calculations. Round final answer to 0 decimal places, eg. 5,275.) NPV $ Should the company purchase the saw? Thin company the saw. You are considering opening a new restaurant in the Texas Burgers chain. The new restaurant will have annual revenue of $313,200 and operating expenses of $156,600. The annual depreciation and amortization for the assets used in the restaurant will equal $52,200. An annual capital expenditure of $12,000 will be required to offset wear and tear on the assets used in the restaurant, but no additions to working capital will be required. The marginal tax rate will be 30 percent. Calculate the incremental annual after-taxfree cash flow for the project. Incremental annual after-tax free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts