Question: Answer both please Determine NPV for Professional Athlete's Compensation. It's widely reported that last year's star player signed a three-year $10 million contract. Suppose you

Answer both please

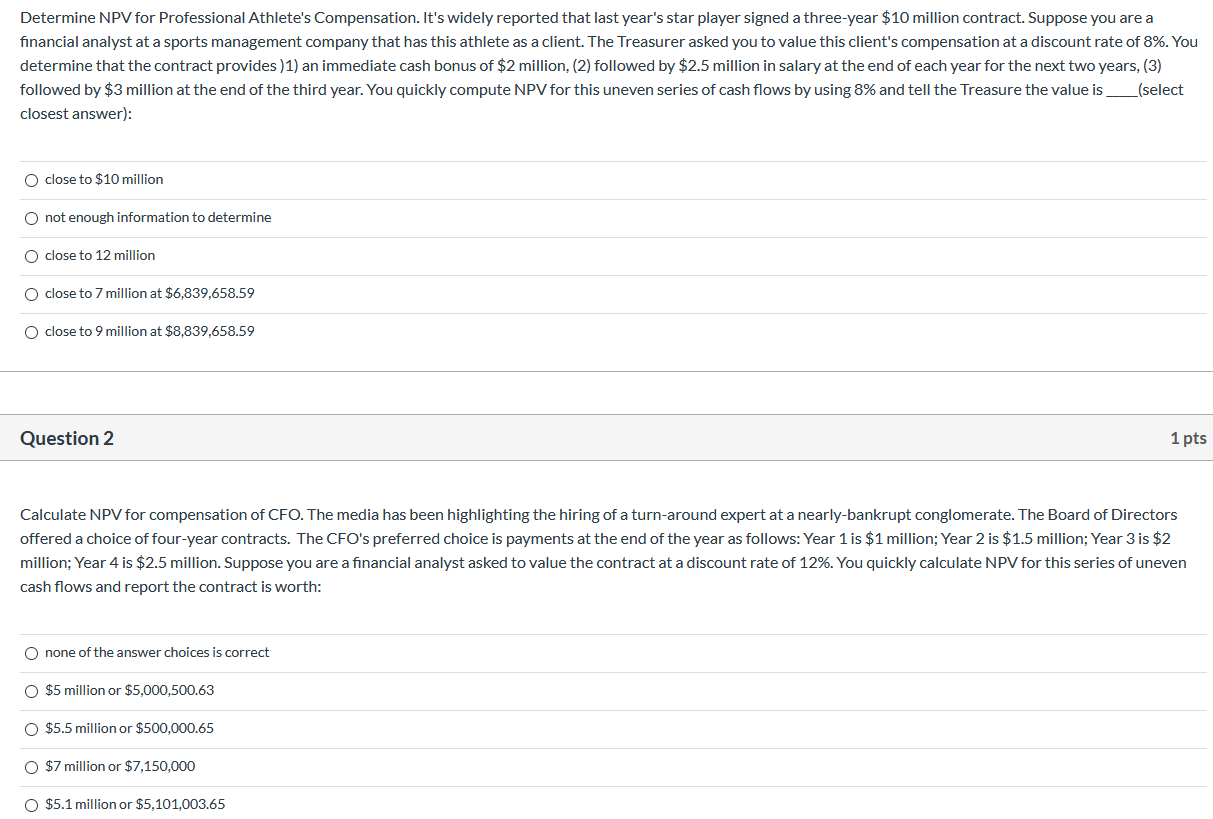

Determine NPV for Professional Athlete's Compensation. It's widely reported that last year's star player signed a three-year $10 million contract. Suppose you are a financial analyst at a sports management company that has this athlete as a client. The Treasurer asked you to value this client's compensation at a discount rate of 8%. You determine that the contract provides )1) an immediate cash bonus of $2 million, (2) followed by $2.5 million in salary at the end of each year for the next two years, (3) followed by $3 million at the end of the third year. You quickly compute NPV for this uneven series of cash flows by using 8% and tell the Treasure the value is select closest answer): O close to $10 million not enough information to determine O close to 12 million O close to 7 million at $6,839,658.59 O close to 9 million at $8,839,658.59 Question 2 1 pts Calculate NPV for compensation of CFO. The media has been highlighting the hiring of a turn-around expert at a nearly-bankrupt conglomerate. The Board of Directors offered a choice of four-year contracts. The CFO's preferred choice is payments at the end of the year as follows: Year 1 is $1 million; Year 2 is $1.5 million; Year 3 is $2 million; Year 4 is $2.5 million. Suppose you are a financial analyst asked to value the contract at a discount rate of 12%. You quickly calculate NPV for this series of uneven cash flows and report the contract is worth: O none of the answer choices is correct O $5 million or $5,000,500.63 O $5.5 million or $500,000.65 O $7 million or $7,150,000 O $5.1 million or $5,101,003.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts