Question: answer both please help Wildhorse Corp. management is expecting a project to generate after-tax income of $78,310 in each of the next three years. The

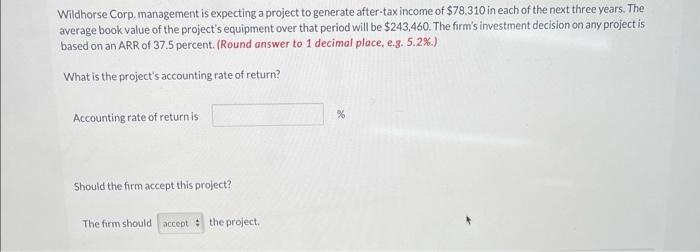

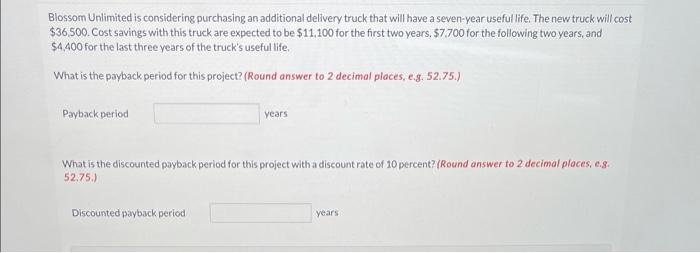

Wildhorse Corp. management is expecting a project to generate after-tax income of $78,310 in each of the next three years. The average book value of the project's equipment over that period will be $243,460. The firm's investment decision on any project is based on an ARR of 37.5 percent. (Round answer to 1 decimal place, e.3. 5.2\%.) What is the project's accounting rate of return? Accounting rate of return is % Should the firm accept this project? The firm should the project. Blossom Unlimited is considering purchasing an additional delivery truck that will have a seven-year useful life. The new truck will cost $36,500. Cost savings with this truck are expected to be $11,100 for the first two years, $7,700 for the following two years, and $4,400 for the last three years of the truck's useful life. What is the payback period for this project? (Round answer to 2 decimal places, e.g. 52.75.) Payback period years What is the discounted payback period for this project with a discount rate of 10 percent? (Round answer to 2 decimal ploces, e. . 52.75.) Discounted payback period years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts