Question: answer both please Nick Thompson recently won $20 million in lottery, and he used the money to purchase assets and create a firm called Upstart

answer both please

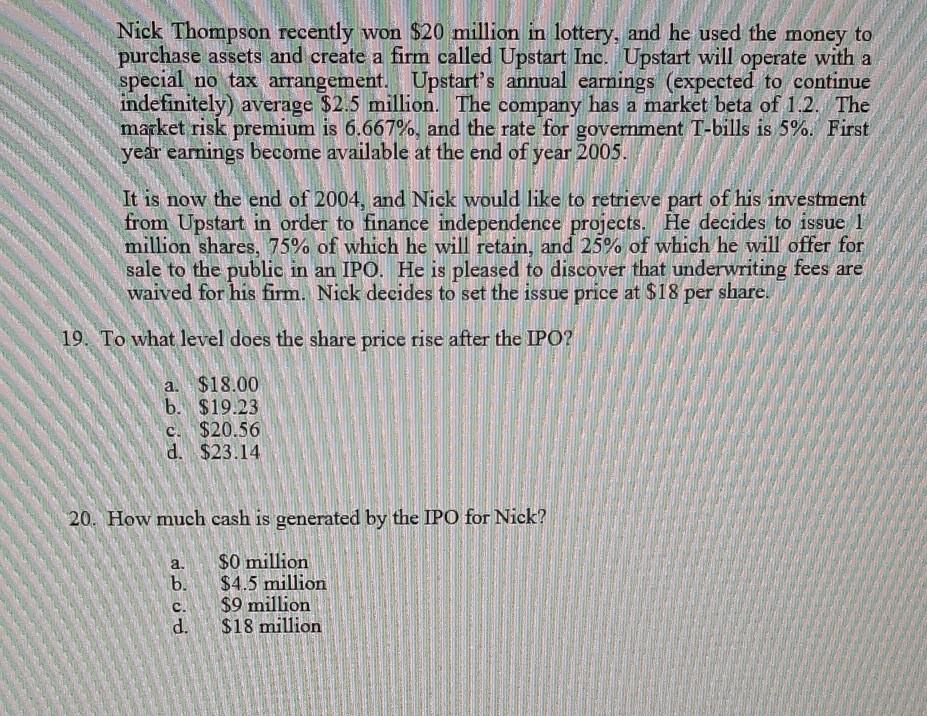

Nick Thompson recently won $20 million in lottery, and he used the money to purchase assets and create a firm called Upstart Inc. Upstart will operate with a special no tax arrangement. Upstart's annual earnings (expected to continue indefinitely) average $2.5 million. The company has a market beta of 1.2. The market risk premium is 6.667%, and the rate for government T-bills is 5%. First year earnings become available at the end of year 2005. It is now the end of 2004, and Nick would like to retrieve part of his investment from Upstart in order to finance independence projects. He decides to issue 1 million shares, 75% of which he will retain, and 25% of which he will offer for sale to the public in an IPO. He is pleased to discover that underwriting fees are waived for his firm. Nick decides to set the issue price at $18 per share. 19. To what level does the share price rise after the IPO? a. $18.00 b. $19.23 c. $20.56 d. $23.14 20. How much cash is generated by the IPO for Nick? a. b. C. d. $0 million $4.5 million $9 million $18 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts