Question: answer both please thumbs up if correct! Assume the current 1-year LIBOR rate is 5.00% per annum on a continuously compounded basis. What is the

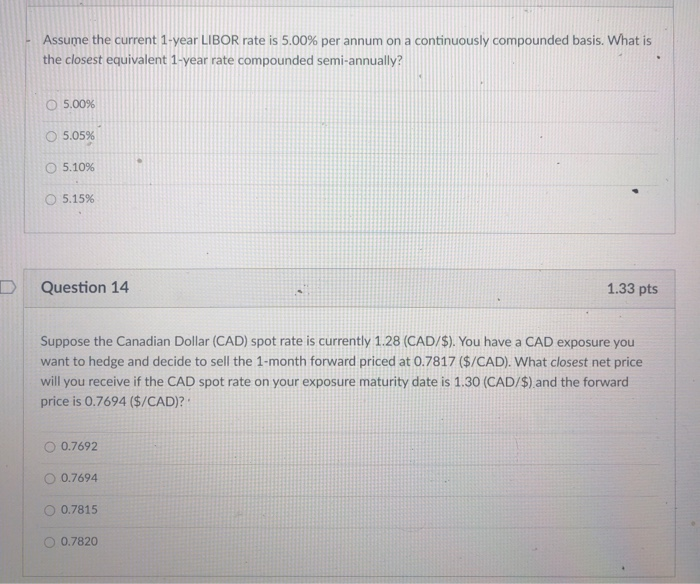

Assume the current 1-year LIBOR rate is 5.00% per annum on a continuously compounded basis. What is the closest equivalent 1-year rate compounded semi-annually? O 5.00% 5.05% 05.10% 5.15% D Question 14 1.33 pts Suppose the Canadian Dollar (CAD) spot rate is currently 1.28 (CAD/$). You have a CAD exposure you want to hedge and decide to sell the 1-month forward priced at 0.7817 ($/CAD). What closest net price will you receive if the CAD spot rate on your exposure maturity date is 1.30 (CAD/$) and the forward price is 0.7694 ($/CAD)? 0.7692 0.7694 0.7815 0.7820

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts