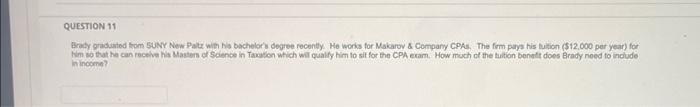

Question: answer both pls for upvote Him so that he can receive his Masters of Saience in Taxgtion which was qually him to sit for the

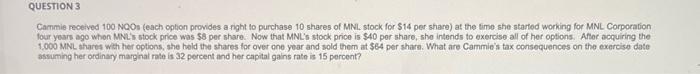

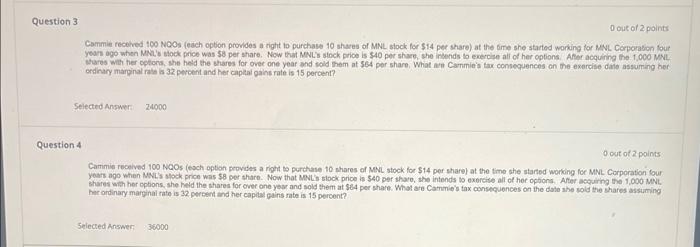

Him so that he can receive his Masters of Saience in Taxgtion which was qually him to sit for the CPh exam. How much of the tution benatt does Brady noed to incude hincomats Cammie received 100 NQOs (each cption provides a right to purchase 10 shares of MNL. stock for $14 per share) at the time she started working for MNL Corporation tour years ago whon MNL's stock price was $6 per share. Now that MNL's stock price is $40 per share, sho intends to exercise all of her options. Afier acquiring the 1.000 MNL thares with her options, she held the shares for over cone year and sold them at $64 per share. What are Cammie's tax consoquences on the exercise date aswuming her ordinary margnal rate is 32 percent and her capital gains rate is 15 percent? 0 out of 2 points Commie recelved 100 NOOS (esch option provides a right to purchase 10 shaves of MNL slock for \$14 per share) at the firre she started wanking for MNL Corporabon fouir years ogo when MN2's stock price Was $8 per share. Now that MNL's slock price is $40 per share, she insends to enercise ail of her options. Afier acquiring the. 1.000 MNL toures with her cefons, she held the orares for over one year and sold them at Sed per share, What art Csmie's tax consequences on the exercise daite assumang her ordinary marginal rate is 32 percent and her capial gains rate is 15 percent? 0 out of 2 points Cammis received 100 NQOs (esch opton provites a right to purchase 10 shares of MNL stock for $14 per share) at the time she started working foe MNL Corporation four shares with her ophons, she held the shares for over one your and sold them at \$e4 per share. What ate Cammie's tax consecuences on the dote ahe sold the shares assuming her ordinary marginal rato is 32 percent and her capias gains rate is 15 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts