Question: answer both questions 3. You plan to purchase a house for $900,000 using a 30year mortgage obtained from your local bank. You will make a

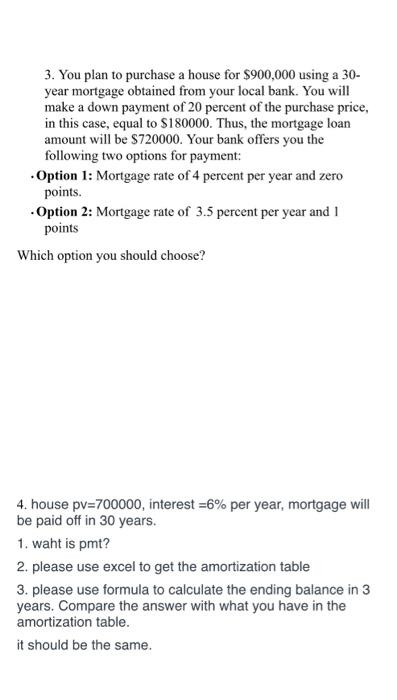

3. You plan to purchase a house for $900,000 using a 30year mortgage obtained from your local bank. You will make a down payment of 20 percent of the purchase price, in this case, equal to $180000. Thus, the mortgage loan amount will be $720000. Your bank offers you the following two options for payment: - Option 1: Mortgage rate of 4 percent per year and zero points. - Option 2: Mortgage rate of 3.5 percent per year and 1 points Which option you should choose? 4. house pv=700000, interest =6% per year, mortgage will be paid off in 30 years. 1. waht is pmt? 2. please use excel to get the amortization table 3. please use formula to calculate the ending balance in 3 years. Compare the answer with what you have in the amortization table. it should be the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts