Question: answer both questions correctly for a like. The possibility that more than one discount rate can cause the net present value of an investment to

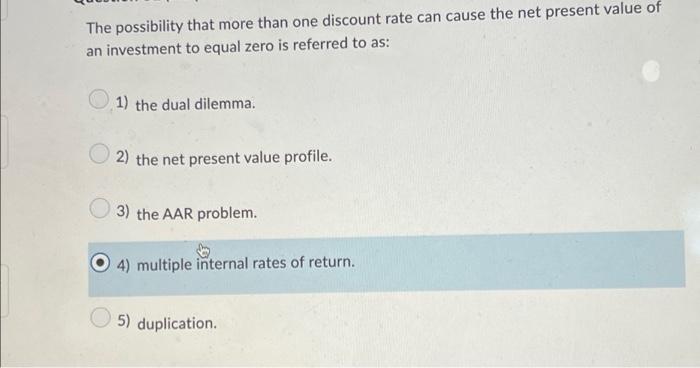

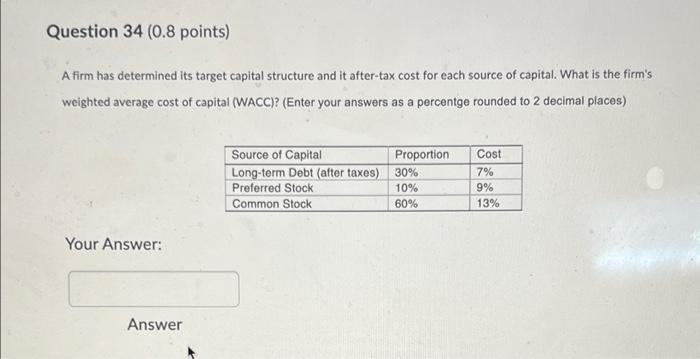

The possibility that more than one discount rate can cause the net present value of an investment to equal zero is referred to as: 1) the dual dilemma. 2) the net present value profile. 3) the AAR problem. 4) multiple internal rates of return. 5) duplication. Question 34 (0.8 points) A firm has determined its target capital structure and it after-tax cost for each source of capital. What is the firm's weighted average cost of capital (WACC)? (Enter your answers as a percentge rounded to 2 decimal places) Source of Capital Proportion Cost Long-term Debt (after taxes) 30% 7% Preferred Stock 10% 9% Common Stock 60% 13% Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts