Question: Answer both questions. Do not answer if you cannot fully answer both. 1. 2. Here are data on two companies. The T-bill rate is 50%

Answer both questions. Do not answer if you cannot fully answer both.

1.

2.

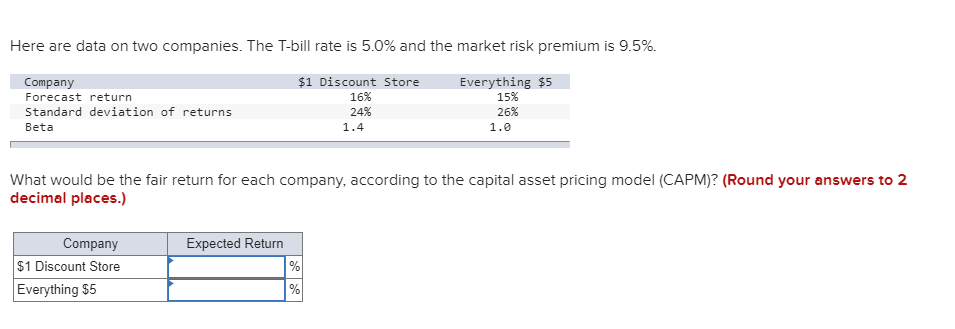

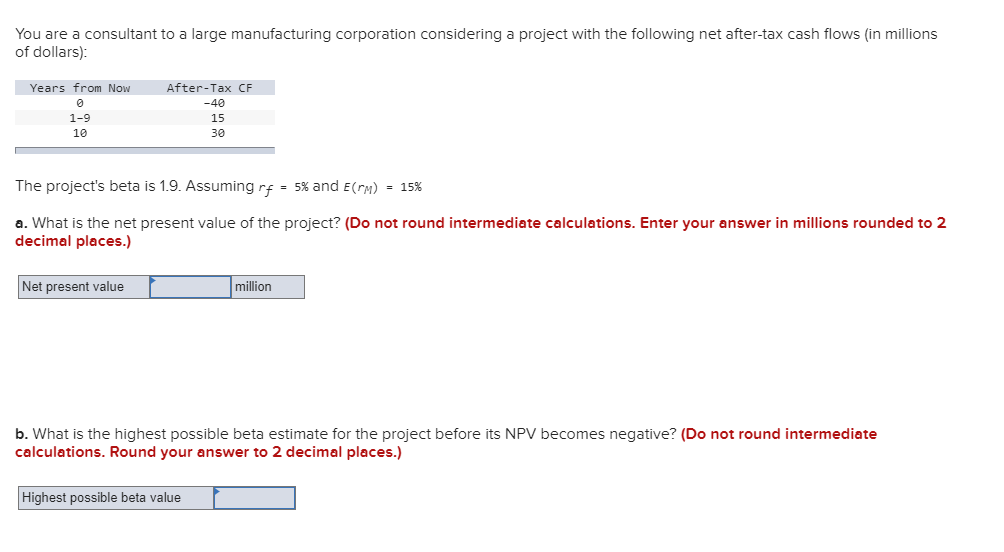

Here are data on two companies. The T-bill rate is 50% and the market risk premium is 9.5%. Company Forecast return Standard deviation of returns Beta $1 Discount Store 16% 24% Everything $5 15% 26% 1.4 1.0 What would be the fair return for each company, according to the capital asset pricing model (CAPM)? (Round your answers to 2 decimal places.) Company Expected Return $1 Discount Store Everything S5 You are a consultant to a large manufacturing corporation considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax CF 1-9 10 -40 15 30 The project's beta is 1.9. Assuming rf-5% and E(rm)-15% a. What is the net present value of the project? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Net present value million b. What is the highest possible beta estimate for the project before its NPV becomes negative? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Highest possible beta value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts