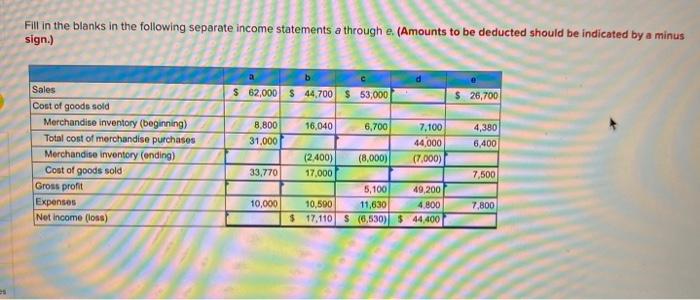

Question: answer both questions for a like! Fill in the blanks in the following separate income statements a through e. (Amounts to be deducted should be

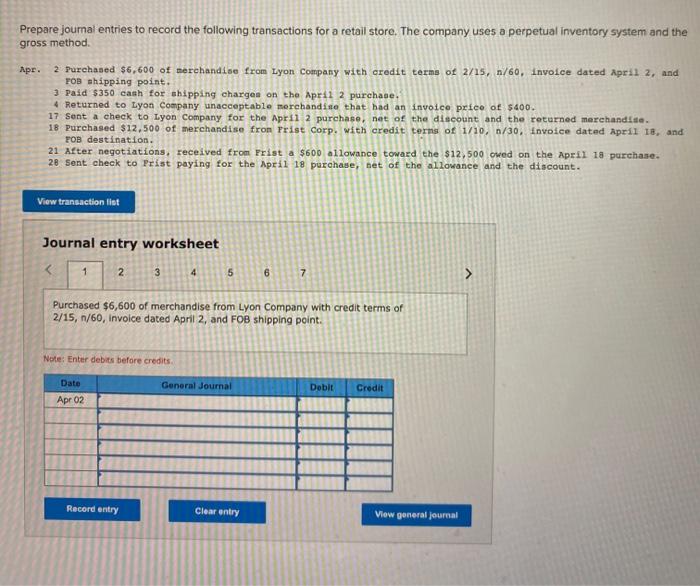

Fill in the blanks in the following separate income statements a through e. (Amounts to be deducted should be indicated by a minus sign.) $ 62,000 $ 44.700 $ 53,000 $ 26,700 8,800 31,000 4,380 6,400 Sales Cost of goods sold Merchandise inventory (beginning) Total cost of merchandise purchases Merchandise inventory (ending) Cost of goods sold Gross profit Expenses Net Income (loss) 33,770 16,040 6,700 7.100 44,000 (2.400) (8.000) (7.000) 17.000 5,100 49,200 10,590 11,630 4.800 $ 17.110 s (0,530) $ 44,400 7,500 10,000 7,800 Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method Apr. 2 Purchased $6.600 of merchandise from Lyon Company with credit terms of 2/15, 1/60, Invoice dated April 2, and FOB shipping point. 3 Paid $350 cash for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of $400. 17 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise 18 Purchased $12.500 of merchandise fron Frist Corp. with credit terms of 1/10, 1/30, Invoice dated April 18, and FOB destination. 21 After negotiations, received from Frist a $600 allowance toward the $12,500 owed on the April 18 purchase. 28 Sent check to Peist paying for the April 18 purchase, net of the allowance and the discount. View transaction list Journal entry worksheet 1 2 3 4 5 6 7 Purchased $6,600 of merchandise from Lyon Company with credit terms of 2/15, 1/60, Invoice dated April 2, and FOB shipping point. Note: Enter debits before credits General Journal Dobit Credit Date Apr 02 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts